Ally Financial Inc. (ALLY): Price and Financial Metrics

ALLY Price/Volume Stats

| Current price | $43.99 | 52-week high | $44.50 |

| Prev. close | $43.35 | 52-week low | $22.54 |

| Day low | $43.64 | Volume | 1,988,217 |

| Day high | $44.24 | Avg. volume | 3,371,647 |

| 50-day MA | $40.28 | Dividend yield | 2.84% |

| 200-day MA | $35.46 | Market Cap | 13.37B |

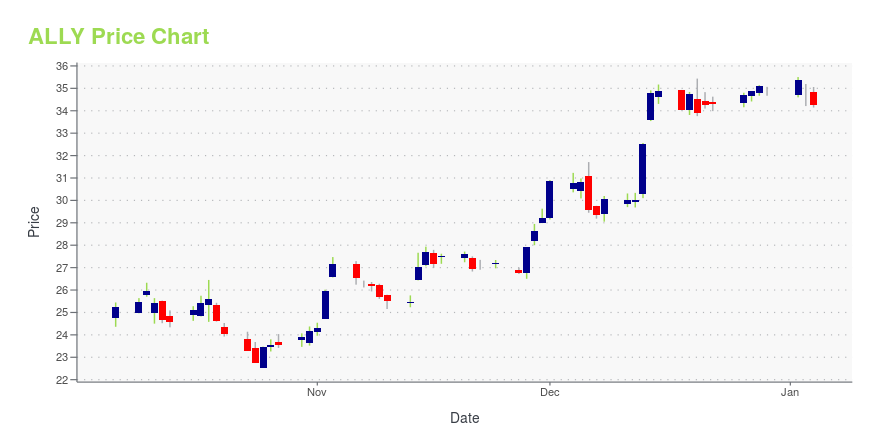

ALLY Stock Price Chart Interactive Chart >

Ally Financial Inc. (ALLY) Company Bio

Ally Financial is a bank holding company organized in Delaware and headquartered in Detroit, Michigan. The company provides financial services including car finance, online banking via a direct bank, corporate lending, vehicle insurance, mortgage loans, and an electronic trading platform to trade financial assets. (Source:Wikipedia)

Latest ALLY News From Around the Web

Below are the latest news stories about ALLY FINANCIAL INC that investors may wish to consider to help them evaluate ALLY as an investment opportunity.

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

Bank Stocks Are Soaring After the Latest Interest Rate News. This Buffett Stock Is Beating Them All, and It Might Surprise You.If you understand why Buffett bought this stock, its rally makes a lot of sense. |

4 Things You Need to Know if You Buy Ally Financial Stock TodayAlly Financial stock could benefit from a Federal Reserve pivot, but there are a few things investors will want to consider first. |

Ally Financial schedules release of fourth quarter and full year 2023 financial resultsAlly Financial Inc. (NYSE: ALLY) has scheduled the release of its fourth quarter and full year 2023 financial results for Friday, January 19, 2024, at approximately 7:30 a.m. ET. The results will be available on the Ally Press Room website (http://media.ally.com). |

14 Best Bank Dividend Stocks To Buy NowIn this article, we discuss 14 best bank dividend stocks to buy now. You can skip our detailed analysis of the banking sector and the performance of bank stocks, and go directly to read 5 Best Bank Dividend Stocks To Buy Now. During most of the 2022 market decline, financial stocks were seen as a […] |

ALLY Price Returns

| 1-mo | 10.44% |

| 3-mo | 12.80% |

| 6-mo | 18.78% |

| 1-year | 55.86% |

| 3-year | -5.02% |

| 5-year | 52.29% |

| YTD | 27.97% |

| 2023 | 49.22% |

| 2022 | -46.89% |

| 2021 | 36.04% |

| 2020 | 20.56% |

| 2019 | 37.94% |

ALLY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ALLY

Want to see what other sources are saying about Ally Financial Inc's financials and stock price? Try the links below:Ally Financial Inc (ALLY) Stock Price | Nasdaq

Ally Financial Inc (ALLY) Stock Quote, History and News - Yahoo Finance

Ally Financial Inc (ALLY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...