Antero Midstream Corporation (AM): Price and Financial Metrics

AM Price/Volume Stats

| Current price | $14.49 | 52-week high | $15.21 |

| Prev. close | $14.40 | 52-week low | $11.50 |

| Day low | $14.31 | Volume | 1,909,985 |

| Day high | $14.52 | Avg. volume | 2,605,261 |

| 50-day MA | $14.65 | Dividend yield | 5.99% |

| 200-day MA | $13.44 | Market Cap | 6.97B |

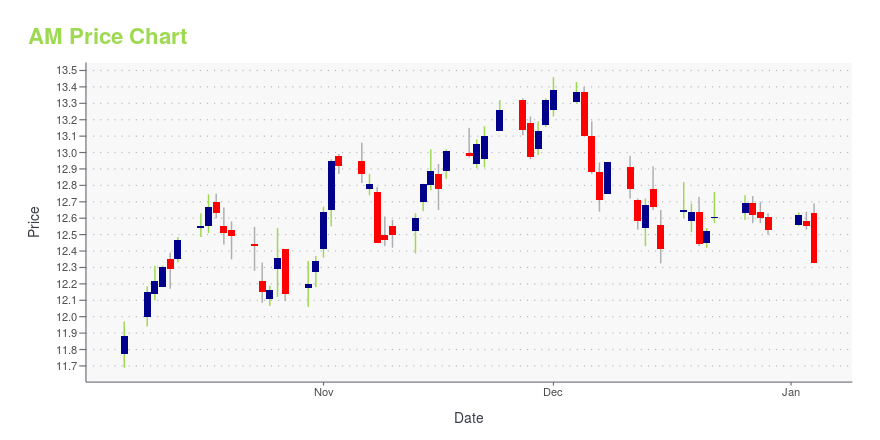

AM Stock Price Chart Interactive Chart >

Antero Midstream Corporation (AM) Company Bio

Antero Midstream Partners LP owns, operates, and develops midstream energy assets which collect natural gas, and oil and condensate from wells in the Marcellus Shale in West Virginia and the Utica Shale in Ohio. The company was founded in 2013 and is based in Denver, Colorado.

Latest AM News From Around the Web

Below are the latest news stories about ANTERO MIDSTREAM CORP that investors may wish to consider to help them evaluate AM as an investment opportunity.

Institutional investors are Antero Midstream Corporation's (NYSE:AM) biggest bettors and were rewarded after last week's US$201m market cap gainKey Insights Given the large stake in the stock by institutions, Antero Midstream's stock price might be vulnerable to... |

Is Now The Time To Put Antero Midstream (NYSE:AM) On Your Watchlist?For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

Antero Midstream Announces Third Quarter 2023 Financial and Operating ResultsAntero Midstream Corporation (NYSE: AM) ("Antero Midstream" or the "Company") today announced its third quarter 2023 financial and operating results. The relevant unaudited condensed consolidated financial statements are included in Antero Midstream's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. |

Antero Resources Announces Third Quarter 2023 Financial and Operating Results and Increased Production GuidanceAntero Resources Corporation (NYSE: AR) ("Antero Resources," "Antero," or the "Company") today announced its third quarter 2023 financial and operating results. The relevant consolidated financial statements are included in Antero Resources' Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. |

Is Antero Midstream Corporation's (NYSE:AM) ROE Of 16% Concerning?One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will... |

AM Price Returns

| 1-mo | -0.94% |

| 3-mo | 3.67% |

| 6-mo | 21.95% |

| 1-year | 33.35% |

| 3-year | 91.03% |

| 5-year | 178.56% |

| YTD | 21.53% |

| 2023 | 25.74% |

| 2022 | 21.97% |

| 2021 | 39.56% |

| 2020 | 27.63% |

| 2019 | -24.47% |

AM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AM

Want to see what other sources are saying about Antero Midstream Corp's financials and stock price? Try the links below:Antero Midstream Corp (AM) Stock Price | Nasdaq

Antero Midstream Corp (AM) Stock Quote, History and News - Yahoo Finance

Antero Midstream Corp (AM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...