Amalgamated Financial Corp. (AMAL): Price and Financial Metrics

AMAL Price/Volume Stats

| Current price | $36.10 | 52-week high | $38.19 |

| Prev. close | $35.30 | 52-week low | $21.33 |

| Day low | $35.19 | Volume | 207,600 |

| Day high | $36.10 | Avg. volume | 152,845 |

| 50-day MA | $34.99 | Dividend yield | 1.36% |

| 200-day MA | $30.02 | Market Cap | 1.11B |

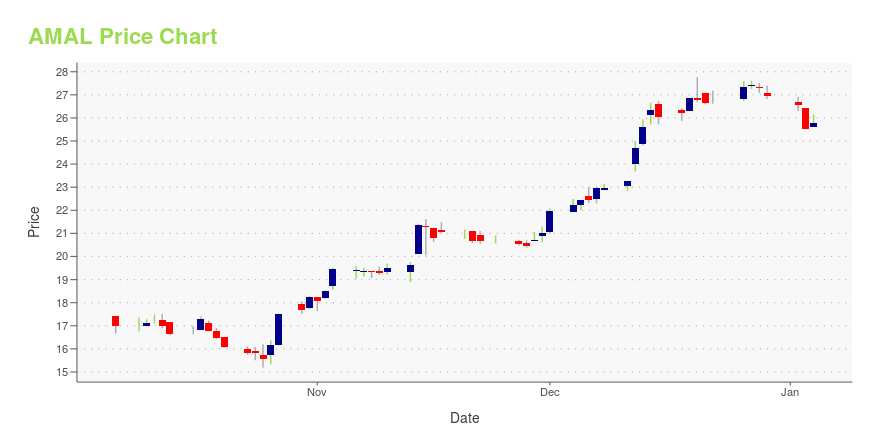

AMAL Stock Price Chart Interactive Chart >

Amalgamated Financial Corp. (AMAL) Company Bio

Amalgamated Bank engages in the provision of financial services. The firm also offers commercial and retail banking, investment management, and trust and custody solutions. The company was founded in 1923 and is headquartered in New York, NY.

AMAL Price Returns

| 1-mo | 7.31% |

| 3-mo | 6.63% |

| 6-mo | 16.26% |

| 1-year | 39.14% |

| 3-year | 140.66% |

| 5-year | 115.54% |

| YTD | 7.86% |

| 2024 | 26.32% |

| 2023 | 19.44% |

| 2022 | 39.78% |

| 2021 | 24.43% |

| 2020 | -27.56% |

AMAL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...