Amalgamated Financial Corp. (AMAL): Price and Financial Metrics

AMAL Price/Volume Stats

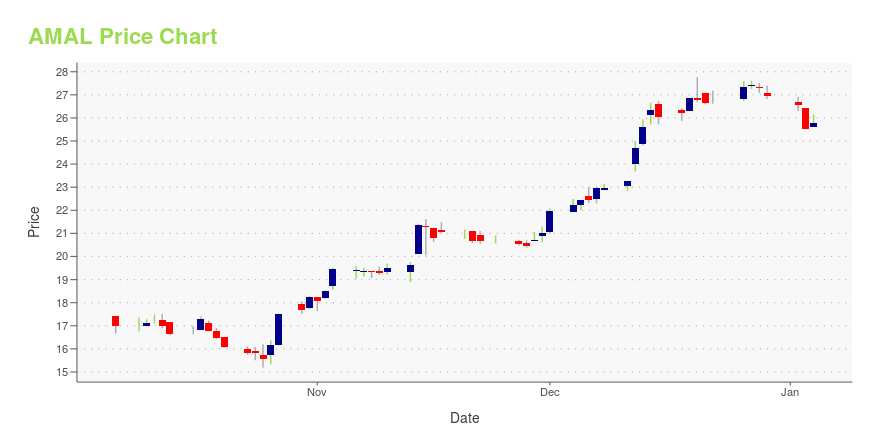

| Current price | $32.21 | 52-week high | $32.79 |

| Prev. close | $31.30 | 52-week low | $15.19 |

| Day low | $30.79 | Volume | 222,713 |

| Day high | $32.26 | Avg. volume | 142,052 |

| 50-day MA | $26.79 | Dividend yield | 1.5% |

| 200-day MA | $23.94 | Market Cap | 983.18M |

AMAL Stock Price Chart Interactive Chart >

Amalgamated Financial Corp. (AMAL) Company Bio

Amalgamated Bank engages in the provision of financial services. The firm also offers commercial and retail banking, investment management, and trust and custody solutions. The company was founded in 1923 and is headquartered in New York, NY.

Latest AMAL News From Around the Web

Below are the latest news stories about AMALGAMATED FINANCIAL CORP that investors may wish to consider to help them evaluate AMAL as an investment opportunity.

Insider Sell Alert: Senior Executive VP and CFO Jason Darby Sells 4,000 Shares of Amalgamated ...Amalgamated Financial Corp (NASDAQ:AMAL) has recently witnessed a notable insider transaction. Senior Executive Vice President and Chief Financial Officer Jason Darby sold 4,000 shares of the company on December 13, 2023. |

Here's Why We Think Amalgamated Financial (NASDAQ:AMAL) Might Deserve Your Attention TodayFor beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

Amalgamated Financial Corp. Appoints Julieta Ross and Scott Stoll to its Board of DirectorsNEW YORK, Nov. 16, 2023 (GLOBE NEWSWIRE) -- Amalgamated Financial Corp. (“Amalgamated” or the “Company”) (Nasdaq: AMAL) today announced it has appointed Julieta Ross and Scott Stoll as its newest members to the Company’s Board of Directors, effective immediately. Dr. Ross has an extensive background in the broader financial services risk management landscape, with over 20 years of global banking technology leadership and experience. With a proven track record of building and scaling businesses w |

Amalgamated Financial's (NASDAQ:AMAL) Dividend Will Be $0.10Amalgamated Financial Corp.'s ( NASDAQ:AMAL ) investors are due to receive a payment of $0.10 per share on 24th of... |

Amalgamated Financial Corp. (NASDAQ:AMAL) Q3 2023 Earnings Call TranscriptAmalgamated Financial Corp. (NASDAQ:AMAL) Q3 2023 Earnings Call Transcript October 26, 2023 Amalgamated Financial Corp. beats earnings expectations. Reported EPS is $0.76, expectations were $0.71. Operator: Good morning, ladies and gentlemen, and welcome to the Amalgamated Financial Corporation Third Quarter 2023 Earnings Conference Call. During today’s presentation, all parties will be on a listen only […] |

AMAL Price Returns

| 1-mo | 25.72% |

| 3-mo | 31.56% |

| 6-mo | 23.82% |

| 1-year | 72.49% |

| 3-year | 120.63% |

| 5-year | 110.43% |

| YTD | 20.60% |

| 2023 | 19.44% |

| 2022 | 39.78% |

| 2021 | 24.43% |

| 2020 | -27.56% |

| 2019 | 1.22% |

AMAL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...