APA Corp. (APA): Price and Financial Metrics

APA Price/Volume Stats

| Current price | $31.21 | 52-week high | $46.15 |

| Prev. close | $31.28 | 52-week low | $27.17 |

| Day low | $30.87 | Volume | 3,493,100 |

| Day high | $31.58 | Avg. volume | 6,307,154 |

| 50-day MA | $29.75 | Dividend yield | 3.26% |

| 200-day MA | $33.04 | Market Cap | 11.58B |

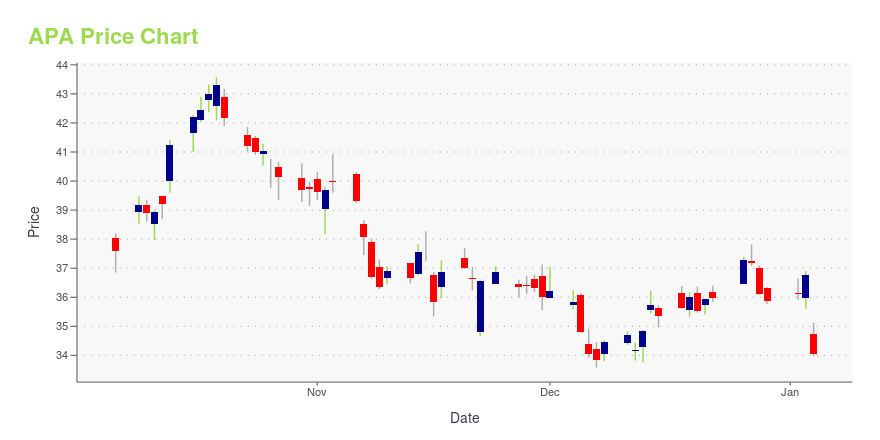

APA Stock Price Chart Interactive Chart >

APA Corp. (APA) Company Bio

PA Corporation is the holding company for Apache Corporation, an American company engaged in hydrocarbon exploration.[2] It is organized in Delaware and headquartered in Houston. The company is ranked 431st on the Fortune 500. (Source:Wikipedia)

Latest APA News From Around the Web

Below are the latest news stories about APA CORP that investors may wish to consider to help them evaluate APA as an investment opportunity.

APA (NASDAQ:APA) Is Paying Out A Dividend Of $0.25APA Corporation's ( NASDAQ:APA ) investors are due to receive a payment of $0.25 per share on 22nd of February. This... |

APA Corporation Declares Cash Dividend on Common SharesHOUSTON, Dec. 12, 2023 (GLOBE NEWSWIRE) -- The board of directors of APA Corporation (Nasdaq: APA) has declared a regular cash dividend on the company's common shares. The dividend on common shares is payable Feb. 22, 2024, to stockholders of record on Jan. 22, 2024, at a rate of 25 cents per share on the corporation’s common stock. About APAAPA Corporation owns consolidated subsidiaries that explore for and produce oil and natural gas in the United States, Egypt and the United Kingdom and that |

Apache Corporation Partners with Borderlands Research Institute on Well Pad Restoration Research Project in the Permian BasinHOUSTON, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Apache Corporation (Nasdaq: APA) today announced a partnership with the Borderlands Research Institute (BRI) at Sul Ross State University in Alpine, Texas, to launch a well pad restoration research project. Through this multiyear partnership, researchers at BRI and Texas Native Seeds, a project of the Caesar Kleberg Wildlife Research Institute at Texas A&M Kingsville, will investigate methods to improve habitat restoration efforts in the Permian Basin w |

An Intrinsic Calculation For APA Corporation (NASDAQ:APA) Suggests It's 23% UndervaluedKey Insights APA's estimated fair value is US$48.09 based on 2 Stage Free Cash Flow to Equity APA is estimated to be... |

Why Are Oil Stocks Down Today?Oil stocks are in the red across the board after OPEC+ opted to push back a key meeting. |

APA Price Returns

| 1-mo | 9.83% |

| 3-mo | -3.18% |

| 6-mo | -1.28% |

| 1-year | -18.58% |

| 3-year | 79.76% |

| 5-year | 43.75% |

| YTD | -10.92% |

| 2023 | -21.24% |

| 2022 | 76.44% |

| 2021 | 90.76% |

| 2020 | -43.71% |

| 2019 | 1.12% |

APA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching APA

Want to see what other sources are saying about Apache Corp's financials and stock price? Try the links below:Apache Corp (APA) Stock Price | Nasdaq

Apache Corp (APA) Stock Quote, History and News - Yahoo Finance

Apache Corp (APA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...