Blue Apron Holdings, Inc. (APRN): Price and Financial Metrics

APRN Price/Volume Stats

| Current price | $12.99 | 52-week high | $19.20 |

| Prev. close | $13.00 | 52-week low | $4.70 |

| Day low | $12.99 | Volume | 112,300 |

| Day high | $13.01 | Avg. volume | 540,373 |

| 50-day MA | $10.48 | Dividend yield | N/A |

| 200-day MA | $8.53 | Market Cap | 82.99M |

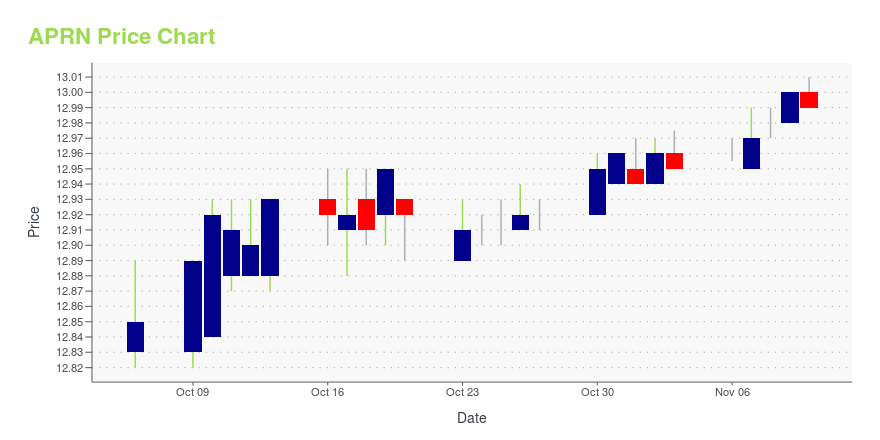

APRN Stock Price Chart Interactive Chart >

Blue Apron Holdings, Inc. (APRN) Company Bio

Blue Apron, Inc. delivers fresh ingredients and recipes to make meals for homes. It offers knives and prep tools, wine, cookware and bakeware, pantry, cookbooks, and gifts. The company sells products through its online store. Blue Apron, Inc. is based in New York,

Latest APRN News From Around the Web

Below are the latest news stories about BLUE APRON HOLDINGS INC that investors may wish to consider to help them evaluate APRN as an investment opportunity.

Blue Apron: meal kit maker is chopped up, sold and reheatedLike planking and peplums, meal kits are a 2010s trend that has grown stale. Blue Apron, once a near $2bn US company, has been bought by mobile restaurant start-up Wonder Group for $103mn. It lets customers focus on particular meal types, such as keto or vegan. |

Wonder Announces Closing of Blue Apron Acquisition to Enhance its Leading Platform for MealtimeNEW YORK, November 13, 2023--Wonder Group, a company founded by entrepreneur Marc Lore that is redefining at-home dining and food delivery, today will close its previously announced acquisition of Blue Apron (Nasdaq: APRN), the pioneer of the meal kit industry in the United States. |

Investor Marc Lore’s Wonder Group closes its deal for meal kit service Blue Apron for $103 millionAll 165 Blue Apron employees have joined Wonder Group, which has bought the Blue Apron brand and marketing. |

Blue Apron Sale Can't Come Fast EnoughBlue Apron issues a going concern warning in its quarterly results due to mounting losses. A deal with FreshRealm in June to outsource its production and fulfillment operations provided a cash infusion, but the company says in a regulatory filing that its ability to continue paying debts depends on the success of its recently announced merger with Wonder and execution of its operating plan. Blue Apron says the deal will be completed "as soon as practicable." |

Blue Apron Makes the Holidays a Breeze With an Assortment of Elevated Seasonal OfferingsNEW YORK, November 07, 2023--Blue Apron (Nasdaq: APRN), the pioneer of the meal kit industry in the U.S., introduces its holiday menu with an assortment of elevated seasonal offerings designed to make celebrating a breeze. Through the end of the year, customers can choose from a selection of three limited-time meal kits, available with or without a subscription, in addition to premium recipes and Add-ons, making purchasing and planning simple. |

APRN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 175.21% |

| 3-year | -70.26% |

| 5-year | -88.90% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -87.67% |

| 2021 | 20.39% |

| 2020 | -15.05% |

| 2019 | -56.99% |

Continue Researching APRN

Want to do more research on Blue Apron Holdings Inc's stock and its price? Try the links below:Blue Apron Holdings Inc (APRN) Stock Price | Nasdaq

Blue Apron Holdings Inc (APRN) Stock Quote, History and News - Yahoo Finance

Blue Apron Holdings Inc (APRN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...