Archrock, Inc. (AROC): Price and Financial Metrics

AROC Price/Volume Stats

| Current price | $21.83 | 52-week high | $23.44 |

| Prev. close | $21.36 | 52-week low | $11.03 |

| Day low | $21.36 | Volume | 2,037,070 |

| Day high | $22.05 | Avg. volume | 1,458,843 |

| 50-day MA | $20.34 | Dividend yield | 2.99% |

| 200-day MA | $17.52 | Market Cap | 3.41B |

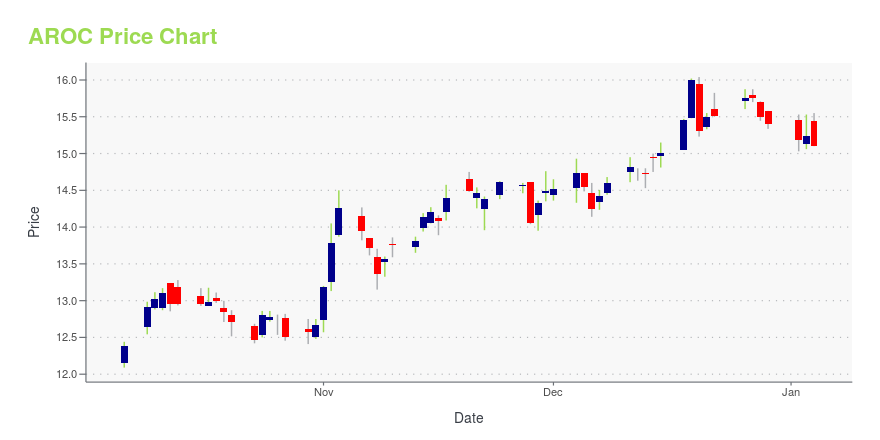

AROC Stock Price Chart Interactive Chart >

Archrock, Inc. (AROC) Company Bio

Archrock, Inc. provides natural gas contract compression services to customers in the oil and natural gas industry in the United States. The company was formerly known as Exterran Holdings, Inc. and changed its name to Archrock, Inc. in November 2015. The company was founded in 1990 and is based in Houston, Texas.

Latest AROC News From Around the Web

Below are the latest news stories about ARCHROCK INC that investors may wish to consider to help them evaluate AROC as an investment opportunity.

Williams (WMB) to Buy Gas Storage Portfolio for $1.95 BillionWilliams (WMB) is set to acquire a $1.95B natural gas assets portfolio in the Gulf Coast, establishing a strong hold over the rapidly evolving energy landscape. |

Shell (SHEL) Secures Natural Gas Production License in VenezuelaShell (SHEL) and Trinidad and Tobago's National Gas Company secure a 30-year license for the Dragon project, boosting economic prospects and LNG production. |

Marathon (MPC), Performance Shipping Ink Time Charter DealMarathon (MPC) secures a lucrative two-year time charter contract with Performance Shipping, ensuring reliable transportation, potentially advantageous rates and strategic partnership. |

Petrobras (PBR) Starts Drilling Well in Equatorial MarginPetrobras (PBR) begins exploration in Brazil's Equatorial Margin, drilling Pitu Oeste well for oil and gas, investing $3.1 billion by 2028. |

Archrock, Inc.'s (NYSE:AROC) Share Price Matching Investor OpinionArchrock, Inc.'s ( NYSE:AROC ) price-to-earnings (or "P/E") ratio of 29x might make it look like a strong sell right... |

AROC Price Returns

| 1-mo | 10.14% |

| 3-mo | 8.96% |

| 6-mo | 32.91% |

| 1-year | 105.18% |

| 3-year | 208.12% |

| 5-year | 183.36% |

| YTD | 44.39% |

| 2023 | 80.96% |

| 2022 | 28.83% |

| 2021 | -7.83% |

| 2020 | -5.58% |

| 2019 | 41.84% |

AROC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AROC

Want to do more research on Archrock Inc's stock and its price? Try the links below:Archrock Inc (AROC) Stock Price | Nasdaq

Archrock Inc (AROC) Stock Quote, History and News - Yahoo Finance

Archrock Inc (AROC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...