ASML Holding N.V. (ASML): Price and Financial Metrics

ASML Price/Volume Stats

| Current price | $888.39 | 52-week high | $1,110.09 |

| Prev. close | $862.63 | 52-week low | $563.99 |

| Day low | $882.23 | Volume | 1,681,620 |

| Day high | $895.57 | Avg. volume | 1,187,297 |

| 50-day MA | $997.76 | Dividend yield | 0.68% |

| 200-day MA | $858.75 | Market Cap | 350.55B |

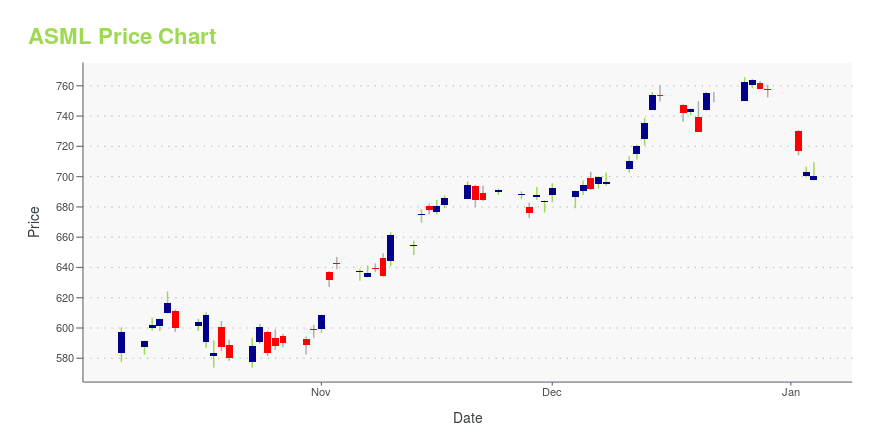

ASML Stock Price Chart Interactive Chart >

ASML Holding N.V. (ASML) Company Bio

ASML Holding N.V. (commonly shortened to ASML and originally standing for "Advanced Semiconductor Materials Lithography") is a Dutch multinational corporation founded in 1984. The company is founded as a joint venture between the Dutch companies Advanced Semiconductor Materials International (ASMI) and Philips. ASML specializes in the development and manufacturing of photolithography systems which are used to produce computer chips. These computer chips are a set of electronic circuits on one small flat piece (or "chip") of semiconductor material, usually silicon. ASML's main business is in the researching, engineering and manufacturing of photolithography machines to be used in the fabrication of nearly all integrated circuits. Currently it is the largest supplier of photolithography systems primarily for the semiconductor industry and the sole supplier of extreme ultraviolet lithography (EUV) photolithography machines in the world. ASML competitors include MKS Instruments, Ultratech, Lam Research and Cadence Design Systems. ASML ranks 1st in Product Quality Score on Comparably vs its competitors. ASML employs more than 31,000 people from 120 nationalities, relies on a vast network of more than 4,600 tier 1 suppliers and has offices in the Netherlands, the United States, Belgium, France, Germany, Ireland, Israel, Italy, the United Kingdom, China, Taiwan, Hong Kong, Japan, Malaysia, Singapore, and South Korea. (Source:Wikipedia)

Latest ASML News From Around the Web

Below are the latest news stories about ASML HOLDING NV that investors may wish to consider to help them evaluate ASML as an investment opportunity.

Trillion-Dollar Titans: Top 3 Stocks to Grab Before They Explode in ValueThese three giants in the semiconductor sector are leading the charge toward trillion-dollar valuations in the coming years. |

12 High Growth International Stocks to BuyIn this article, we discuss the 12 high growth international stocks to buy. If you want to read about some more high growth international stocks, go directly to 5 High Growth International Stocks to Buy. There is general optimism on Wall Street that the Federal Reserve in the United States will be able to achieve […] |

13 Most Profitable Robinhood StocksIn this article, we discuss the 13 most profitable Robinhood stocks. If you want to read about some more Robinhood stocks, go directly to 5 Most Profitable Robinhood Stocks. The stock picking habits of retail investors who use platforms like Reddit to strategize and stock trading applications like Robinhood Markets, Inc. (NASDAQ:HOOD) to carry out […] |

The Best Stocks to Invest $1,000 in Right NowThese three companies are leaders in their space and would be great additions to a diversified portfolio. |

How AI boom will benefit these nine chipmakers in 2024Here are the chip companies that have piqued investor interest going into 2024. |

ASML Price Returns

| 1-mo | -12.61% |

| 3-mo | -3.33% |

| 6-mo | 2.71% |

| 1-year | 26.38% |

| 3-year | 22.86% |

| 5-year | 302.28% |

| YTD | 17.75% |

| 2023 | 39.70% |

| 2022 | -30.21% |

| 2021 | 64.00% |

| 2020 | 66.06% |

| 2019 | 92.73% |

ASML Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ASML

Here are a few links from around the web to help you further your research on Asml Holding Nv's stock as an investment opportunity:Asml Holding Nv (ASML) Stock Price | Nasdaq

Asml Holding Nv (ASML) Stock Quote, History and News - Yahoo Finance

Asml Holding Nv (ASML) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...