Activision Blizzard, Inc (ATVI): Price and Financial Metrics

ATVI Price/Volume Stats

| Current price | $94.42 | 52-week high | $94.57 |

| Prev. close | $94.47 | 52-week low | $70.94 |

| Day low | $94.31 | Volume | 7,323,400 |

| Day high | $94.54 | Avg. volume | 8,306,210 |

| 50-day MA | $92.38 | Dividend yield | 1.05% |

| 200-day MA | $83.66 | Market Cap | 74.29B |

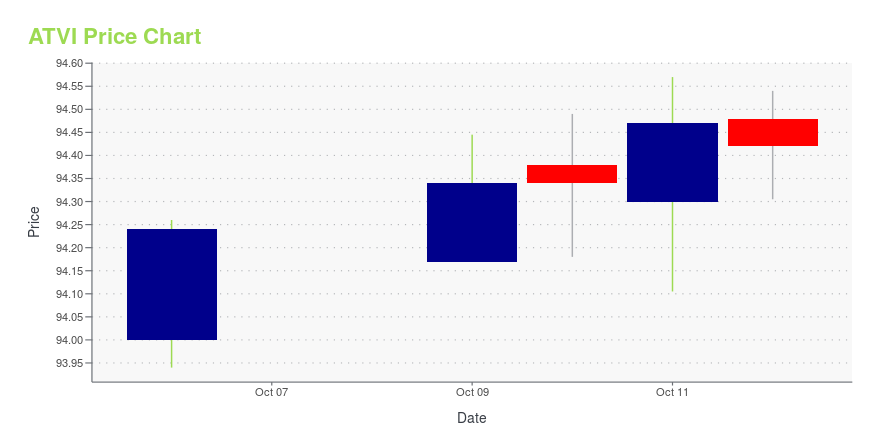

ATVI Stock Price Chart Interactive Chart >

Activision Blizzard, Inc (ATVI) Company Bio

Activision Blizzard develops and publishes online, personal computer (PC), video game console, handheld, mobile, and tablet games worldwide. The company was founded in 2008 and is based in Santa Monica, California.

Latest ATVI News From Around the Web

Below are the latest news stories about ACTIVISION BLIZZARD INC that investors may wish to consider to help them evaluate ATVI as an investment opportunity.

7 Stocks to Cash In on This Little-Known $22.5 Trillion OpportunitySpending across numerous industries will make the digital consumer the driving force in the rise of these digital leisure stocks. |

Top video game titles to watch out for this holiday seasonMicrosoft (MSFT) was granted approval by UK regulators to cement its $69 billion acquisition of developer Activision Blizzard (ATVI). This deal will be the largest ever in the video game industry, coming ahead of the holiday shopping season. Yahoo Finance Tech Editor Dan Howley breaks down the top gaming titles set to be released in the coming weeks and months. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

LULU Stock Replaces Microsoft's New Acquisition In S&P 500; How Does It Compare?Lululemon joined the S&P 500 and replaced Microsoft's recent acquisition, Activision Blizzard. LULU has outperformed the S&P 500 year to date. |

Did Microsoft Waste $69 Billion on Activision Blizzard?After nearly two years of regulatory proceedings, Microsoft (NASDAQ: MSFT) finally completed the acquisition of leading game producer Activision Blizzard. The $68.7 billion acquisition is one of the largest in Microsoft's history. In July, Microsoft agreed to make one of the all-time best-selling franchises, Call of Duty, available to Sony and Nintendo's game consoles for 10 years. |

2 Green Flags for Microsoft's FutureMicrosoft (NASDAQ: MSFT) has been a company to watch this year after becoming one of the biggest names in artificial intelligence (AI) and completing its purchase of game developer Activision Blizzard. Only a decade ago, Microsoft appeared to be fading from relevancy, losing ground to the likes of Apple and Alphabet. In 2023, Microsoft has emerged as a major player in AI. |

ATVI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 3.58% |

| 3-year | 14.22% |

| 5-year | 102.34% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 15.74% |

| 2021 | -28.00% |

| 2020 | 57.29% |

| 2019 | 28.62% |

ATVI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ATVI

Want to see what other sources are saying about Activision Blizzard Inc's financials and stock price? Try the links below:Activision Blizzard Inc (ATVI) Stock Price | Nasdaq

Activision Blizzard Inc (ATVI) Stock Quote, History and News - Yahoo Finance

Activision Blizzard Inc (ATVI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...