Auburn National Bancorporation, Inc. (AUBN): Price and Financial Metrics

AUBN Price/Volume Stats

| Current price | $18.85 | 52-week high | $23.20 |

| Prev. close | $19.08 | 52-week low | $16.48 |

| Day low | $18.69 | Volume | 5,800 |

| Day high | $19.08 | Avg. volume | 3,401 |

| 50-day MA | $18.51 | Dividend yield | 5.56% |

| 200-day MA | $19.83 | Market Cap | 65.86M |

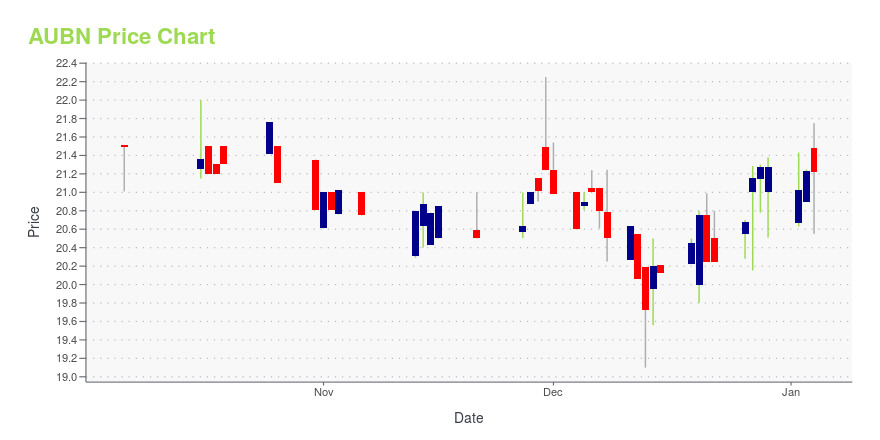

AUBN Stock Price Chart Interactive Chart >

Auburn National Bancorporation, Inc. (AUBN) Company Bio

Auburn National Bancorporation, Inc. offers various banking products and services in East Alabama. The company was founded in 1907 and is based in Auburn, Alabama.

Latest AUBN News From Around the Web

Below are the latest news stories about AUBURN NATIONAL BANCORPORATION INC that investors may wish to consider to help them evaluate AUBN as an investment opportunity.

12 Best Micro-Cap Dividend Stocks To Buy NowIn this article, we discuss 12 best micro-cap dividend stocks to buy now. You can skip our detailed analysis of dividend stocks and their performance in the past, and go directly to read 5 Best Micro-Cap Dividend Stocks To Buy Now. Microcap stocks refer to the shares of publicly traded companies that have a small […] |

Be Sure To Check Out Auburn National Bancorporation, Inc. (NASDAQ:AUBN) Before It Goes Ex-DividendAuburn National Bancorporation, Inc. ( NASDAQ:AUBN ) stock is about to trade ex-dividend in four days. The ex-dividend... |

3 Stocks With Dividend Yields Over 5%These three impressive dividend stocks have enticing dividend yields over 5% in addition to resilient business models. |

Auburn National Bancorporation (NASDAQ:AUBN) Has Affirmed Its Dividend Of $0.27The board of Auburn National Bancorporation, Inc. ( NASDAQ:AUBN ) has announced that it will pay a dividend of $0.27... |

Auburn National Bancorporation, Inc. Declares Quarterly DividendAUBURN, Ala., Nov. 14, 2023 (GLOBE NEWSWIRE) -- On November 14, 2023, the Board of Directors of Auburn National Bancorporation, Inc. (the “Company”) (Nasdaq: AUBN) declared a fourth quarter $0.27 per share cash dividend, payable December 26, 2023 to shareholders of record as of December 8, 2023. About Auburn National Bancorporation Auburn National Bancorporation, Inc. (the “Company”) is the parent company of AuburnBank (the “Bank”), with total assets of approximately $1.0 billion. The Bank is an |

AUBN Price Returns

| 1-mo | 5.01% |

| 3-mo | 10.21% |

| 6-mo | -4.92% |

| 1-year | -9.16% |

| 3-year | -38.27% |

| 5-year | -42.48% |

| YTD | -8.94% |

| 2023 | -2.81% |

| 2022 | -25.99% |

| 2021 | -20.35% |

| 2020 | -19.63% |

| 2019 | 71.98% |

AUBN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AUBN

Want to do more research on Auburn National Bancorporation Inc's stock and its price? Try the links below:Auburn National Bancorporation Inc (AUBN) Stock Price | Nasdaq

Auburn National Bancorporation Inc (AUBN) Stock Quote, History and News - Yahoo Finance

Auburn National Bancorporation Inc (AUBN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...