Atea Pharmaceuticals Inc. (AVIR): Price and Financial Metrics

AVIR Price/Volume Stats

| Current price | $3.92 | 52-week high | $4.60 |

| Prev. close | $3.90 | 52-week low | $2.77 |

| Day low | $3.78 | Volume | 188,095 |

| Day high | $3.97 | Avg. volume | 351,757 |

| 50-day MA | $3.60 | Dividend yield | N/A |

| 200-day MA | $3.57 | Market Cap | 330.15M |

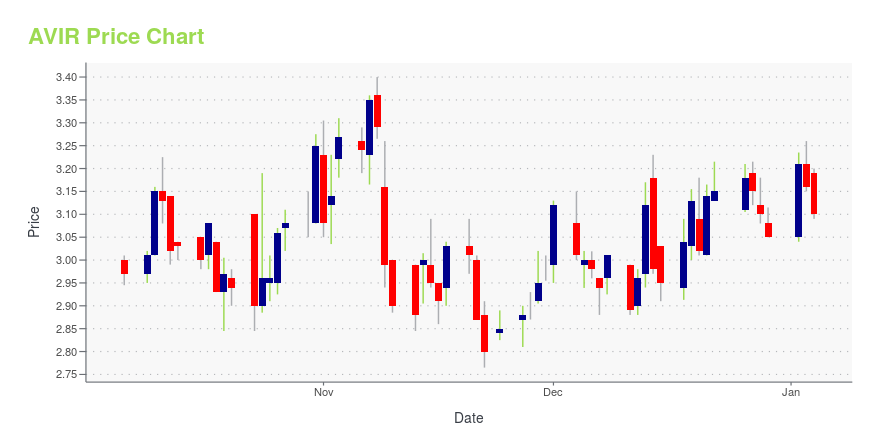

AVIR Stock Price Chart Interactive Chart >

Atea Pharmaceuticals Inc. (AVIR) Company Bio

Atea Pharmaceuticals, Inc. is a clinical stage company, which focuses on discovering, developing, and commercializing antiviral therapeutics. Its product pipelines include Coronaviridae, Flaviviridae, and Paramyxovirdae. The company was founded by Jean-Pierre Sommadossi and David Chu in July 2012 and is headquartered in Boston, MA.

Latest AVIR News From Around the Web

Below are the latest news stories about ATEA PHARMACEUTICALS INC that investors may wish to consider to help them evaluate AVIR as an investment opportunity.

Atea Pharmaceuticals Presents Promising Bemnifosbuvir and Ruzasvir Combination Data for the Treatment of Hepatitis C Virus at AASLD The Liver Meeting 2023First Clinical Data for Coadministration of Bemnifosbuvir and Ruzasvir Show Combination Was Well Tolerated in a Phase 1 Study Plasma Pharmacokinetic (PK) Profiles of Bemnifosbuvir and Ruzasvir Were Not Affected by Food or Concomitant Dosing, Indicating Low Risk of Drug-Drug Interactions Bemnifosbuvir and Ruzasvir are Potent Direct Acting Antivirals In Vitro with Favorable Antiviral Profiles Against HCV NS5A and NS5B Resistant Associated Variants (RAVs) BOSTON, Nov. 13, 2023 (GLOBE NEWSWIRE) -- A |

Atea Pharmaceuticals, Inc. (NASDAQ:AVIR) Q3 2023 Earnings Call TranscriptAtea Pharmaceuticals, Inc. (NASDAQ:AVIR) Q3 2023 Earnings Call Transcript November 8, 2023 Atea Pharmaceuticals, Inc. beats earnings expectations. Reported EPS is $-0.4, expectations were $-0.46. Operator: Good afternoon, ladies and gentlemen. Welcome to the Atea Pharmaceuticals Third Quarter 2023 Financial Results and Business Update Conference Call. [Operator Instructions]. I would now like to turn the […] |

Q3 2023 Atea Pharmaceuticals Inc Earnings CallQ3 2023 Atea Pharmaceuticals Inc Earnings Call |

Atea Pharmaceuticals Reports Third Quarter 2023 Financial Results and Provides Business UpdatePatient enrollment continues in global Phase 3 SUNRISE-3 trial evaluating bemnifosbuvir for COVID-19; first interim analysis expected 1Q24 Phase 2 bemnifosbuvir and ruzasvir combination trial for hepatitis C (HCV) advances, initial results from 60-patient lead-in cohort expected 1Q24 Conference call at 4:30 pm ET today BOSTON, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Atea Pharmaceuticals, Inc. (Nasdaq: AVIR) (“Atea” or the “Company”), a clinical-stage biopharmaceutical company engaged in the discovery |

Atea Pharmaceuticals Announces Participation at Upcoming Investor ConferencesBOSTON, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Atea Pharmaceuticals, Inc. (Nasdaq: AVIR) (“Atea”), a clinical-stage biopharmaceutical company engaged in the discovery and development of oral antiviral therapeutics for serious viral diseases, today announced that members of the Atea management team will participate in and present a business update at the following investor conferences in November. Jefferies London Healthcare Conference, Company Presentation on Wednesday, November 15, 2023 at 11:00 a.m |

AVIR Price Returns

| 1-mo | 16.32% |

| 3-mo | 5.66% |

| 6-mo | 2.08% |

| 1-year | 17.72% |

| 3-year | -84.95% |

| 5-year | N/A |

| YTD | 28.52% |

| 2023 | -36.59% |

| 2022 | -46.20% |

| 2021 | -78.60% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...