Bed Bath & Beyond Inc. (BBBY): Price and Financial Metrics

BBBY Price/Volume Stats

| Current price | $0.08 | 52-week high | $30.00 |

| Prev. close | $0.10 | 52-week low | $0.07 |

| Day low | $0.07 | Volume | 192,179,900 |

| Day high | $0.10 | Avg. volume | 122,761,367 |

| 50-day MA | $0.77 | Dividend yield | N/A |

| 200-day MA | $4.26 | Market Cap | 32.15M |

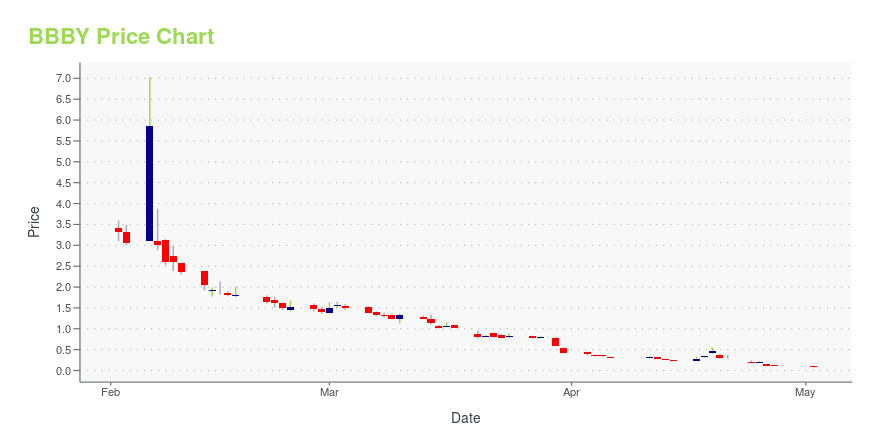

BBBY Stock Price Chart Interactive Chart >

Bed Bath & Beyond Inc. (BBBY) Company Bio

Bed Bath & Beyond operates a chain of retail stores, offering a range of domestics merchandise, including bed linens and related items, bath items, kitchen textiles, home furnishings, fine tabletops, basic housewares, general home furnishings, and other merchandise. The company was founded in 1971 and is based in Union, New Jersey.

Latest BBBY News From Around the Web

Below are the latest news stories about BED BATH & BEYOND INC that investors may wish to consider to help them evaluate BBBY as an investment opportunity.

7 Retail Stocks to Avoid Following the BBBY BankruptcyWith Bed Bath & Beyond declaring a not-unexpected bankruptcy, these are the other retail stocks to sell before conditions worsen. |

Bed Bath and Beyond Liquidation Starts; Here's What They're Giving AwayDON'T MISS: After Filing for Bankruptcy, Could Bed Bath & Beyond's Stock Rise? While the chain is still trying to find a buyer for a last-minute Hail Mary, the liquidation process has already begun. On May 2, I popped by the 92,000 square-foot Bed, Bath and Beyond store in Manhattan's Chelsea neighborhood to check out how the sales process is going. |

Bed Bath & Beyond Starts Delisting Process Today. It Was Once a Star Stock.The retailer was a star stock during its first 20 years as a public company, but things fell apart in recent years. |

Q1 2023 Kite Realty Group Trust Earnings CallQ1 2023 Kite Realty Group Trust Earnings Call |

Q1 2023 National Retail Properties Inc Earnings CallQ1 2023 National Retail Properties Inc Earnings Call |

BBBY Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -99.72% |

| 5-year | -99.16% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -82.78% |

| 2021 | -17.91% |

| 2020 | 4.99% |

| 2019 | 60.83% |

Continue Researching BBBY

Want to see what other sources are saying about Bed Bath & Beyond Inc's financials and stock price? Try the links below:Bed Bath & Beyond Inc (BBBY) Stock Price | Nasdaq

Bed Bath & Beyond Inc (BBBY) Stock Quote, History and News - Yahoo Finance

Bed Bath & Beyond Inc (BBBY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...