Brickell Biotech, Inc. (BBI): Price and Financial Metrics

BBI Price/Volume Stats

| Current price | $2.35 | 52-week high | $37.35 |

| Prev. close | $2.30 | 52-week low | $2.21 |

| Day low | $2.21 | Volume | 31,300 |

| Day high | $2.37 | Avg. volume | 206,730 |

| 50-day MA | $3.42 | Dividend yield | N/A |

| 200-day MA | $8.77 | Market Cap | 6.75M |

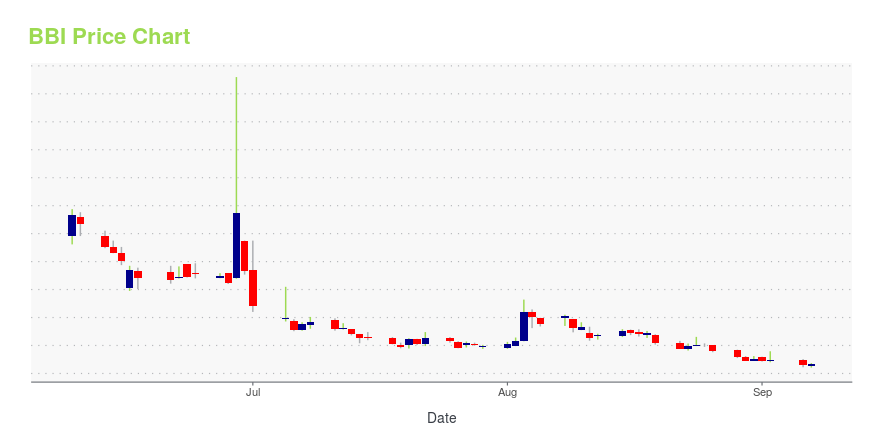

BBI Stock Price Chart Interactive Chart >

Brickell Biotech, Inc. (BBI) Company Bio

Brickell Biotech, Inc., a clinical-stage pharmaceutical company, focuses on identifying, developing, and commercializing various prescription therapeutics for the treatment of debilitating skin diseases in the United States. The company's lead product candidate is sofpironium bromide that is in phase 3 clinical trial to treat patients with primary axillary hyperhidrosis. Its pipeline consists of potential novel therapeutics for hyperhidrosis and other prevalent dermatological conditions. Brickell Biotech, Inc. has a collaboration agreement with AnGes, Inc. for the development of a novel DNA vaccine candidate for COVID-19. The company was founded in 2009 and is headquartered in Boulder, Colorado.

Latest BBI News From Around the Web

Below are the latest news stories about BRICKELL BIOTECH INC that investors may wish to consider to help them evaluate BBI as an investment opportunity.

Fresh Tracks Therapeutics Initiates Multiple Ascending Dose Portion of Phase 1 Study of DYRK1A Inhibitor FRTX-02FRTX-02 has been well tolerated in completed SAD cohorts; dosing of remaining SAD cohorts to continue in parallel with MAD cohorts dosing On track to report SAD and MAD topline results from FRTX-02 Phase 1 study by early 2023 BOULDER, Colo., Sept. 13, 2022 (GLOBE NEWSWIRE) -- Fresh Tracks Therapeutics, Inc. (“FRTX” or the “Company”) (Nasdaq: FRTX), a clinical-stage pharmaceutical company striving to transform patient lives by developing innovative and groundbreaking prescription therapeutics for |

Brickell Biotech changes name to Fresh Tracks Therapeutics

|

Brickell Biotech Announces Corporate Rebranding to Fresh Tracks TherapeuticsNew name, logo, website, and branding reflect the Company’s strategic shift toward developing potentially groundbreaking autoimmune and inflammatory disease therapies Company to begin trading under new ticker symbol “FRTX” on September 8, 2022 Company also establishes Scientific Advisory Board consisting of renowned autoimmune and inflammatory disease experts to provide strategic guidance for the research and development of FRTX’s novel pipeline BOULDER, Colo., Sept. 07, 2022 (GLOBE NEWSWIRE) -- |

Analysts Offer Insights on Healthcare Companies: Brickell Biotech (BBI), Phio Pharmaceuticals (PHIO) and Albireo Pharma (ALBO)There's a lot to be optimistic about in the Healthcare sector as 3 analysts just weighed in on Brickell Biotech (BBI – Research Report), Phio Pharmaceuticals (PHIO – Research Report) and Albireo Pharma (ALBO – Research Report) with bullish sentiments. Brickell Biotech (BBI) H.C. Wainwright analyst Ram Selvaraju reiterated a Buy rating on Brickell Biotech today and set a price target of $4.50. The company's shares closed last Monday at $3.50, close to its 52-week low of $2.88. According to TipRanks. |

Brickell Biotech Reports Second Quarter 2022 Financial Results and Provides Corporate UpdatePhase 1 study of BBI-02 progressing well and expect to initiate MAD part of the study next month On track to report SAD and MAD topline results from BBI-02 Phase 1 study by early 2023 Development of BBI-10 and next-generation kinase inhibitors advancing through early preclinical stage studies BOULDER, Colo., Aug. 11, 2022 (GLOBE NEWSWIRE) -- Brickell Biotech, Inc. (“Brickell” or the “Company”) (Nasdaq: BBI), a clinical-stage pharmaceutical company striving to transform patient lives by developin |

BBI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -94.88% |

| 5-year | -99.36% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | -70.67% |

| 2020 | -47.97% |

| 2019 | -81.84% |

Loading social stream, please wait...