Banco De Chile Banco De Chile ADS (BCH): Price and Financial Metrics

BCH Price/Volume Stats

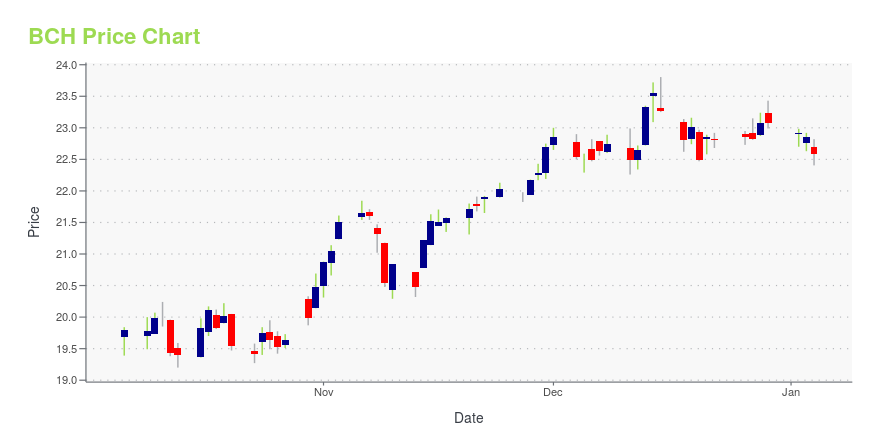

| Current price | $23.65 | 52-week high | $24.79 |

| Prev. close | $23.63 | 52-week low | $19.20 |

| Day low | $23.62 | Volume | 135,580 |

| Day high | $23.84 | Avg. volume | 203,692 |

| 50-day MA | $23.60 | Dividend yield | 5.2% |

| 200-day MA | $22.50 | Market Cap | 11.95B |

BCH Stock Price Chart Interactive Chart >

Banco De Chile Banco De Chile ADS (BCH) Company Bio

Banco de Chile provides traditional banking products and specialized financial services to large corporations, micro, small, and medium sized companies, and individuals in Chile. The company was founded in 1893 and is based in Santiago, Chile.

Latest BCH News From Around the Web

Below are the latest news stories about BANK OF CHILE that investors may wish to consider to help them evaluate BCH as an investment opportunity.

The 3 Best Bargain Cryptos to Buy Before the Bitcoin HalvingWith Bitcoin's next halving approaching, these three cryptos have significant upside potential as the crypto market enters a new frenzy. |

New Strong Sell Stocks for November 27thARLP, BCH and CPSI have been added to the Zacks Rank #5 (Strong Sell) List on November 27, 2023. |

Banco de Chile (NYSE:BCH) Q3 2023 Earnings Call TranscriptBanco de Chile (NYSE:BCH) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good afternoon, everyone, and welcome to Banco de Chile’s Third Quarter 2023 Results Conference Call. If you need a copy of the management’s financial review, it is available on the company’s website. With us today, we have Mr. Rodrigo Aravena, Chief Economist […] |

7 Millionaire-Maker Blockchain Stocks to Hold Through Thick and ThinDitch the crypto noise focusing on the tech behind it. |

Want to Get Rich? 3 Game-Changing Blockchain Stocks to Buy Right NowLooking beyond crypto? |

BCH Price Returns

| 1-mo | 3.59% |

| 3-mo | 6.53% |

| 6-mo | 13.04% |

| 1-year | 9.81% |

| 3-year | 61.39% |

| 5-year | 3.34% |

| YTD | 8.34% |

| 2023 | 20.39% |

| 2022 | 39.17% |

| 2021 | -21.67% |

| 2020 | 1.11% |

| 2019 | -24.67% |

BCH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BCH

Want to see what other sources are saying about Bank Of Chile's financials and stock price? Try the links below:Bank Of Chile (BCH) Stock Price | Nasdaq

Bank Of Chile (BCH) Stock Quote, History and News - Yahoo Finance

Bank Of Chile (BCH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...