BioCryst Pharmaceuticals, Inc. (BCRX): Price and Financial Metrics

BCRX Price/Volume Stats

| Current price | $4.16 | 52-week high | $9.06 |

| Prev. close | $4.21 | 52-week low | $4.03 |

| Day low | $4.03 | Volume | 2,735,500 |

| Day high | $4.17 | Avg. volume | 3,312,426 |

| 50-day MA | $5.11 | Dividend yield | N/A |

| 200-day MA | $6.03 | Market Cap | 857.58M |

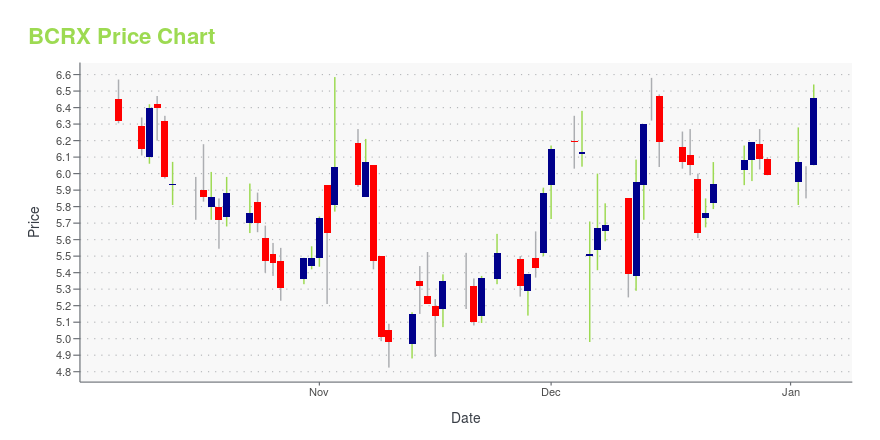

BCRX Stock Price Chart Interactive Chart >

BioCryst Pharmaceuticals, Inc. (BCRX) Company Bio

Biocryst Pharmaceuticals designs, optimizes and develops novel small molecule drugs that block key enzymes involved in rare diseases. The company was founded in 1986 and is based in Durham, North Carolina.

Latest BCRX News From Around the Web

Below are the latest news stories about BIOCRYST PHARMACEUTICALS INC that investors may wish to consider to help them evaluate BCRX as an investment opportunity.

BioCryst Announces Publication of Data from Open-label Extension of the APeX-2 Pivotal Trial of ORLADEYO® (berotralstat)– Results published in JACI: In Practice show rapid and sustained reductions in HAE attacks and improved quality of life over 96 weeks of treatment with ORLADEYO –RESEARCH TRIANGLE PARK, N.C., Dec. 19, 2023 (GLOBE NEWSWIRE) -- BioCryst Pharmaceuticals, Inc. (Nasdaq: BCRX) today announced that data from the open-label extension (OLE) of the APeX-2 trial of oral, once-daily ORLADEYO® (berotralstat) for the prophylactic treatment of hereditary angioedema (HAE) in patients 12 years and older have be |

BioCryst Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)RESEARCH TRIANGLE PARK, N.C., Dec. 05, 2023 (GLOBE NEWSWIRE) -- BioCryst Pharmaceuticals, Inc. (Nasdaq: BCRX) today announced that the compensation committee of BioCryst’s board of directors granted 16 newly-hired employees stock options to purchase an aggregate of 74,500 shares, and restricted stock units (RSUs) covering an aggregate of 51,050 shares, of BioCryst common stock. The options and RSUs were granted as of November 30, 2023, as inducements material to each employee entering into emplo |

J.P. Morgan Recommends These 2 ‘Strong Buy’ Stocks With Over 60% Upside PotentialNovember has a been a good month for the markets, with solid gains on the S&P 500 of 8.5%, bringing the year-to-date haul to ~19%. The question now is, where do we go from here? Don’t go anywhere, rather, stay in the stock market, appears to be the recommendation of JPMorgan’s global investment strategist Madison Faller, who points to three factors that should be supportive going forward. First, the US economy is cooling a bit, enough to ease the threat of overheating; second, the rate of inflat |

BioCryst Announces Approval of ORLADEYO® (berotralstat) by the National Administration of Drugs, Foods, and Medical Devices (ANMAT) in ArgentinaRESEARCH TRIANGLE PARK, N.C., Nov. 29, 2023 (GLOBE NEWSWIRE) -- BioCryst Pharmaceuticals, Inc. (Nasdaq: BCRX) today announced that the National Administration of Drugs, Foods, and Medical Devices (ANMAT) in Argentina has granted approval for oral, once-daily ORLADEYO® (berotralstat) for the prophylaxis of hereditary angioedema (HAE) attacks in adults and pediatric patients 12 years of age or older. “We continue to make strides to bring ORLADEYO to patients living with HAE in Latin America in col |

BioCryst to Present at Upcoming Investor ConferencesRESEARCH TRIANGLE PARK, N.C., Nov. 21, 2023 (GLOBE NEWSWIRE) -- BioCryst Pharmaceuticals, Inc. (Nasdaq: BCRX) today announced that the company will present at the 6th Annual Evercore ISI HealthCONx Conference on Tuesday, November 28th in Miami at 9:35 a.m. ET and the 35th Annual Piper Sandler Healthcare Conference on Wednesday, November 29th in New York at 12:30 p.m. ET. Links to the live audio webcasts and replays of the presentations may be accessed in the Investors & Media section of BioCryst |

BCRX Price Returns

| 1-mo | -19.22% |

| 3-mo | -23.53% |

| 6-mo | -21.66% |

| 1-year | -44.75% |

| 3-year | -66.18% |

| 5-year | -45.90% |

| YTD | -30.55% |

| 2023 | -47.82% |

| 2022 | -17.11% |

| 2021 | 85.91% |

| 2020 | 115.94% |

| 2019 | -57.25% |

Continue Researching BCRX

Want to do more research on Biocryst Pharmaceuticals Inc's stock and its price? Try the links below:Biocryst Pharmaceuticals Inc (BCRX) Stock Price | Nasdaq

Biocryst Pharmaceuticals Inc (BCRX) Stock Quote, History and News - Yahoo Finance

Biocryst Pharmaceuticals Inc (BCRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...