Barclays PLC ADR (BCS): Price and Financial Metrics

BCS Price/Volume Stats

| Current price | $11.98 | 52-week high | $12.11 |

| Prev. close | $11.75 | 52-week low | $6.23 |

| Day low | $11.86 | Volume | 11,422,557 |

| Day high | $12.01 | Avg. volume | 15,090,280 |

| 50-day MA | $11.15 | Dividend yield | 4.37% |

| 200-day MA | $8.92 | Market Cap | 44.39B |

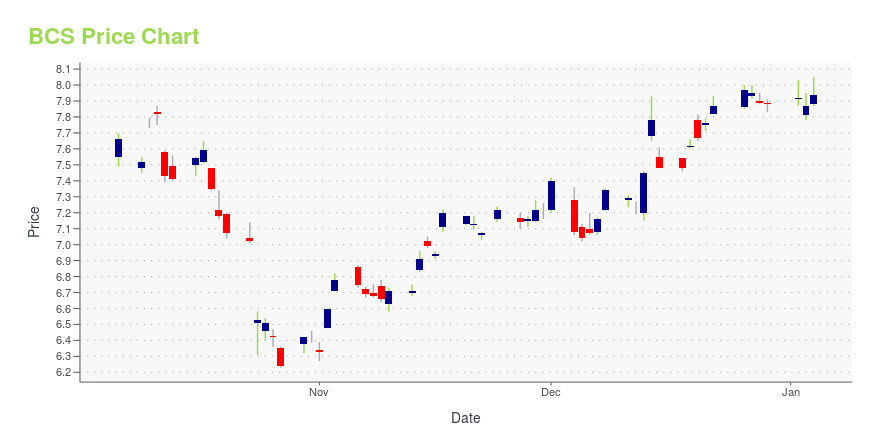

BCS Stock Price Chart Interactive Chart >

Barclays PLC ADR (BCS) Company Bio

Barclays (/ˈbɑːrkliz, -leɪz/) is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services. (Source:Wikipedia)

Latest BCS News From Around the Web

Below are the latest news stories about BARCLAYS PLC that investors may wish to consider to help them evaluate BCS as an investment opportunity.

‘Barclays mistakenly froze my account – then told me to visit a foodbank’A severely ill Barclays customer was left with no cash for Christmas and told to go to a food bank after the lender froze her account without warning. |

Barclays Delays Bonus Pool Decision for Last-Minute Mandates(Bloomberg) -- Barclays Plc has delayed the final decision on the bonus pool for this year after top investment bankers asked for more time to reflect business they won in recent days or expect to win. Most Read from BloombergVilified Zero-Day Options Blamed by Traders for S&P DeclineHarvard Financial Pain Grows as Blavatnik Joins Donor RevoltGiuliani Files for Bankruptcy After $148 Million Defamation LossUS Inflation Report to Show Fed’s Battle Is Now All But CompleteBull Run Steams Ahead Befor |

Barclays commits to Canary Wharf in rare boost for office districtBarclays has struck a deal to remain at its Canary Wharf headquarters until 2039 in a rare boost for the beleaguered office district. |

Barclays Sublets Canary Wharf Office, Extends Lease on Other(Bloomberg) -- Barclays Plc has agreed a pair of deals with landlord Canary Wharf Group that effectively allow the bank to walk away from one major office in the east London financial district while extending its lease on another. Most Read from BloombergVilified Zero-Day Options Blamed by Traders for S&P DeclineHarvard Financial Pain Grows as Blavatnik Joins Donor RevoltGiuliani Files for Bankruptcy After $148 Million Defamation LossUS Inflation Report to Show Fed’s Battle Is Now All But Comple |

Barclays agrees deal to stay at London’s Canary Wharf until 2039Barclays has reached a deal to stay in its Canary Wharf headquarters until at least 2039, in a boost to London’s docklands financial centre after other high-profile tenants opted to move elsewhere. The bank has agreed a five-year lease extension on its 32-storey tower at One Churchill Place, its base since 2005. It will also pay at least £260mn in a separate deal to hand its tenancy of a second building, 10 Cabot Square, back to Canary Wharf Group (CWG). |

BCS Price Returns

| 1-mo | 13.99% |

| 3-mo | 14.97% |

| 6-mo | 60.02% |

| 1-year | 60.34% |

| 3-year | 42.54% |

| 5-year | 82.37% |

| YTD | 56.77% |

| 2023 | 5.80% |

| 2022 | -22.01% |

| 2021 | 31.65% |

| 2020 | -13.25% |

| 2019 | 31.86% |

BCS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BCS

Want to see what other sources are saying about Barclays Plc's financials and stock price? Try the links below:Barclays Plc (BCS) Stock Price | Nasdaq

Barclays Plc (BCS) Stock Quote, History and News - Yahoo Finance

Barclays Plc (BCS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...