Flanigan's Enterprises, Inc. (BDL): Price and Financial Metrics

BDL Price/Volume Stats

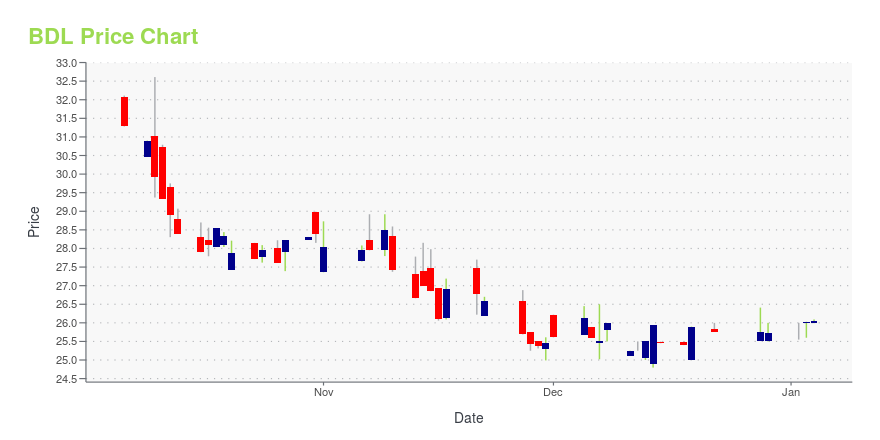

| Current price | $26.07 | 52-week high | $29.72 |

| Prev. close | $26.13 | 52-week low | $24.43 |

| Day low | $25.94 | Volume | 600 |

| Day high | $26.07 | Avg. volume | 2,998 |

| 50-day MA | $26.35 | Dividend yield | 1.92% |

| 200-day MA | $26.48 | Market Cap | 48.49M |

BDL Stock Price Chart Interactive Chart >

BDL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

BDL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BDL

Here are a few links from around the web to help you further your research on Flanigans Enterprises Inc's stock as an investment opportunity:Flanigans Enterprises Inc (BDL) Stock Price | Nasdaq

Flanigans Enterprises Inc (BDL) Stock Quote, History and News - Yahoo Finance

Flanigans Enterprises Inc (BDL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...