Bel Fuse Inc. - (BELFA): Price and Financial Metrics

BELFA Price/Volume Stats

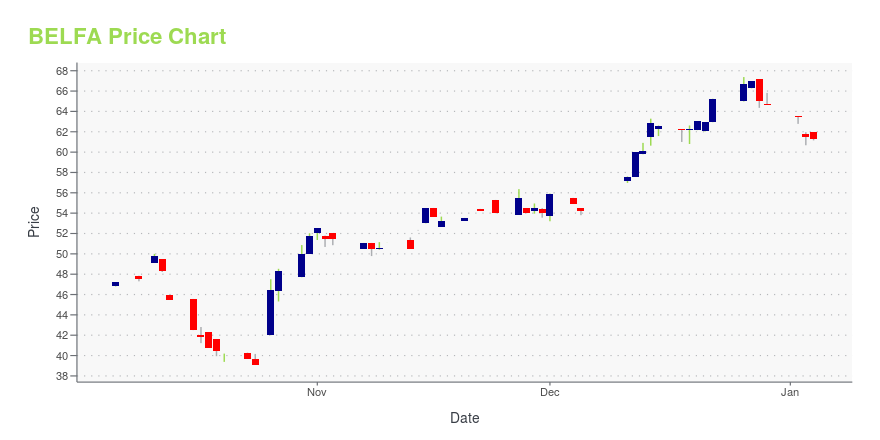

| Current price | $90.76 | 52-week high | $91.24 |

| Prev. close | $89.44 | 52-week low | $38.82 |

| Day low | $89.54 | Volume | 6,800 |

| Day high | $91.24 | Avg. volume | 12,125 |

| 50-day MA | $81.49 | Dividend yield | 0.28% |

| 200-day MA | $67.23 | Market Cap | 1.15B |

BELFA Stock Price Chart Interactive Chart >

Bel Fuse Inc. - (BELFA) Company Bio

Bel Fuse Inc. designs, manufactures and markets a broad array of products that power, protect and connect electronic circuits. These products are primarily used in the networking, telecommunications, computing, military, aerospace, transportation and broadcasting industries. The company was founded in 1949 and is based in Jersey City, New Jersey.

Latest BELFA News From Around the Web

Below are the latest news stories about BEL FUSE INC that investors may wish to consider to help them evaluate BELFA as an investment opportunity.

Is Arista Networks (ANET) Stock Outpacing Its Computer and Technology Peers This Year?Here is how Arista Networks (ANET) and Bel Fuse (BELFB) have performed compared to their sector so far this year. |

Are Investors Undervaluing Bel Fuse (BELFB) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Intuit (INTU) Launches 'Business Differently' Brand PlatformIntuit (INTU) announces a global QuickBooks brand platform, "Business Differently," focused on reaching the growing population of solopreneur small business owners. |

Bel Fuse Inc. (BELFB) Hit a 52 Week High, Can the Run Continue?Bel Fuse (BELFB) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues. |

KLA Corporation (KLAC) Hits Fresh High: Is There Still Room to Run?KLA (KLAC) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues. |

BELFA Price Returns

| 1-mo | 11.10% |

| 3-mo | 31.65% |

| 6-mo | 32.51% |

| 1-year | 48.79% |

| 3-year | 586.66% |

| 5-year | 511.57% |

| YTD | 40.77% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 14.81% |

| 2020 | -16.19% |

| 2019 | 19.66% |

BELFA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BELFA

Want to do more research on Bel Fuse Inc's stock and its price? Try the links below:Bel Fuse Inc (BELFA) Stock Price | Nasdaq

Bel Fuse Inc (BELFA) Stock Quote, History and News - Yahoo Finance

Bel Fuse Inc (BELFA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...