Brookfield Renewable Partners L.P. (BEP): Price and Financial Metrics

BEP Price/Volume Stats

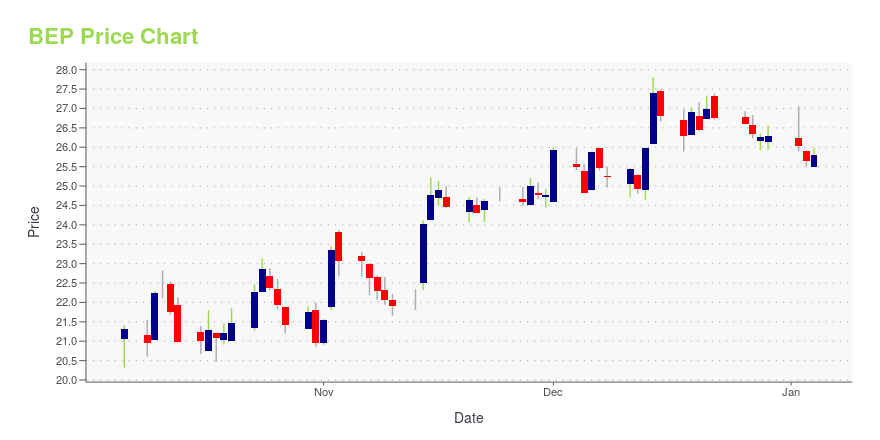

| Current price | $24.27 | 52-week high | $30.14 |

| Prev. close | $24.11 | 52-week low | $19.92 |

| Day low | $24.09 | Volume | 248,626 |

| Day high | $24.56 | Avg. volume | 486,164 |

| 50-day MA | $26.16 | Dividend yield | 5.72% |

| 200-day MA | $24.48 | Market Cap | 6.92B |

BEP Stock Price Chart Interactive Chart >

Brookfield Renewable Partners L.P. (BEP) Company Bio

Brookfield Renewable Energy Partners LP owns a portfolio of renewable power generating facilities in the United States, Canada, Brazil, and Europe. The company was founded in 1999 and is based in Hamilton, Bermuda.

Latest BEP News From Around the Web

Below are the latest news stories about BROOKFIELD RENEWABLE PARTNERS LP that investors may wish to consider to help them evaluate BEP as an investment opportunity.

Brookfield Renewable (BEP) Fell on Macro ConditionsClearBridge Investments, an investment management company, released its “ClearBridge Sustainability Leaders Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. The strategy underperformed its benchmark, the Russell 3000 Index, in the quarter. The strategy gained two out of 10 sectors in which it invested during the quarter, on an absolute […] |

Brookfield Renewable 2024: High-Yield Boom or Bust Coming?One of its peers is struggling mightily. Will Brookfield Renewable follow suit or set its own course? |

3 Renewable Energy Growth Stocks to Buy Hand Over Fist Before 2024These renewable energy stocks could produce supercharged total returns in 2024 and beyond. |

If EPS Growth Is Important To You, Brookfield Renewable (TSE:BEPC) Presents An OpportunityInvestors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks... |

Canada Growth Fund Announces Strategic Investment in Entropy Inc. and Carbon Credit Offtake CommitmentBROOKFIELD, NEWS, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) and Canada Growth Fund Inc. ("CGF") and Advantage Energy Ltd. (TSX: AAV) ("Advantage") today announce that CGF has entered into a strategic investment agreement with Entropy Inc. ("Entropy" or the "Company"), a Calgary-based developer of technologically-advanced carbon capture and sequestration ("CCS") projects with the potential to significantly reduce emissions in Canada and worldwide. CG |

BEP Price Returns

| 1-mo | -4.41% |

| 3-mo | 15.22% |

| 6-mo | -5.36% |

| 1-year | -14.83% |

| 3-year | -29.57% |

| 5-year | 52.93% |

| YTD | -6.44% |

| 2023 | 9.03% |

| 2022 | -26.48% |

| 2021 | -15.72% |

| 2020 | 81.64% |

| 2019 | 90.76% |

BEP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BEP

Want to see what other sources are saying about Brookfield Renewable Partners LP's financials and stock price? Try the links below:Brookfield Renewable Partners LP (BEP) Stock Price | Nasdaq

Brookfield Renewable Partners LP (BEP) Stock Quote, History and News - Yahoo Finance

Brookfield Renewable Partners LP (BEP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...