BankFinancial Corporation (BFIN): Price and Financial Metrics

BFIN Price/Volume Stats

| Current price | $11.74 | 52-week high | $11.84 |

| Prev. close | $11.74 | 52-week low | $8.31 |

| Day low | $11.50 | Volume | 7,100 |

| Day high | $11.74 | Avg. volume | 11,047 |

| 50-day MA | $10.31 | Dividend yield | 3.45% |

| 200-day MA | $9.93 | Market Cap | 146.29M |

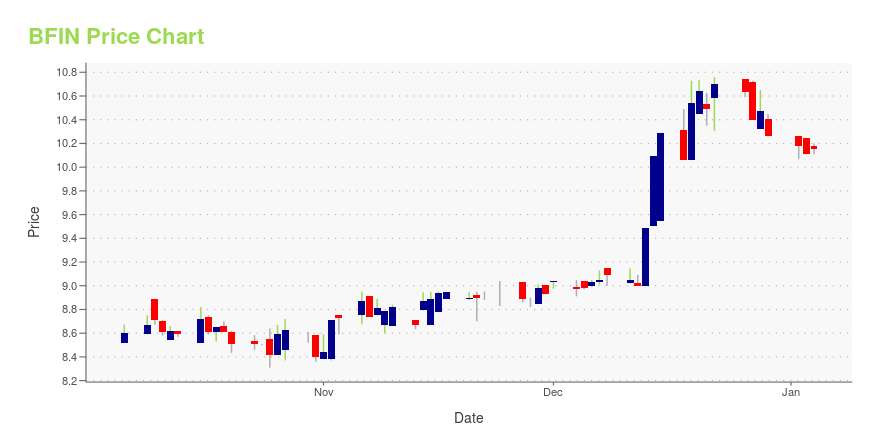

BFIN Stock Price Chart Interactive Chart >

BankFinancial Corporation (BFIN) Company Bio

BankFinancial Corporation operates as the holding company for BankFinancial, F.S.B. that provides commercial, family, and personal banking products and services to individuals, families, and businesses in Illinois. The company was founded in 1924 and is based in Burr Ridge, Illinois.

Latest BFIN News From Around the Web

Below are the latest news stories about BANKFINANCIAL CORP that investors may wish to consider to help them evaluate BFIN as an investment opportunity.

BankFinancial Corporation Extends and Expands Share Repurchase ProgramBURR RIDGE, Ill., Dec. 15, 2023 (GLOBE NEWSWIRE) -- The Board of Directors of BankFinancial Corporation (Nasdaq – BFIN) (the "Company") extended the expiration date of the Company's share repurchase authorization from January 15, 2024, to December 15, 2024, and increased the total number of shares currently authorized for repurchase under the Share Repurchase Program by 200,000 shares. As of December 14, 2023, a total of 13,625 shares remained authorized for purchase pursuant to the previous sha |

BankFinancial Corporation's (NASDAQ:BFIN) top owners are retail investors with 35% stake, while 32% is held by institutionsKey Insights Significant control over BankFinancial by retail investors implies that the general public has more power... |

The BankFinancial Corp (BFIN) Company: A Short SWOT AnalysisUnveiling the Strengths, Weaknesses, Opportunities, and Threats of BankFinancial Corp (BFIN) |

BankFinancial (BFIN) Q3 Earnings Match EstimatesBankFinancial (BFIN) delivered earnings and revenue surprises of 0% and 2.11%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

BankFinancial Corporation Reports Financial Results for the Third Quarter 2023 and Will Host Conference Call and Webcast on Wednesday, November 1, 2023BURR RIDGE, Ill., Oct. 30, 2023 (GLOBE NEWSWIRE) -- BankFinancial Corporation (Nasdaq – BFIN) (the “BankFinancial”) filed its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and a Quarterly Financial and Statistical Supplement in Form 8-K with the U.S. Securities and Exchange Commission (the “SEC”) today. BankFinancial reported net income for the three months ended September 30, 2023, of $2.4 million, or $0.19 per common share, compared to net income of $3.2 million, or $ |

BFIN Price Returns

| 1-mo | 15.55% |

| 3-mo | 18.00% |

| 6-mo | 8.76% |

| 1-year | 37.22% |

| 3-year | 13.78% |

| 5-year | 4.73% |

| YTD | 16.71% |

| 2023 | 2.03% |

| 2022 | 2.66% |

| 2021 | 26.23% |

| 2020 | -29.73% |

| 2019 | -9.99% |

BFIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BFIN

Here are a few links from around the web to help you further your research on BankFinancial CORP's stock as an investment opportunity:BankFinancial CORP (BFIN) Stock Price | Nasdaq

BankFinancial CORP (BFIN) Stock Quote, History and News - Yahoo Finance

BankFinancial CORP (BFIN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...