Biglari Holdings Inc. Class B (BH): Price and Financial Metrics

BH Price/Volume Stats

| Current price | $198.97 | 52-week high | $219.00 |

| Prev. close | $197.84 | 52-week low | $137.01 |

| Day low | $197.50 | Volume | 1,644 |

| Day high | $201.90 | Avg. volume | 2,511 |

| 50-day MA | $193.16 | Dividend yield | N/A |

| 200-day MA | $175.44 | Market Cap | 452.86M |

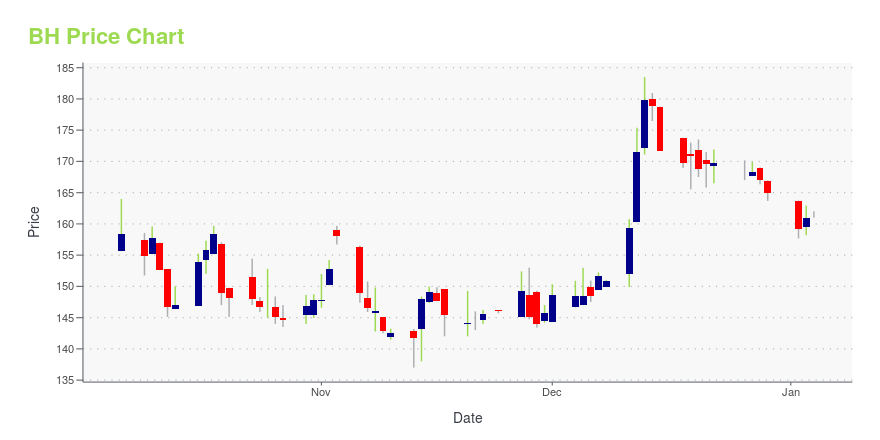

BH Stock Price Chart Interactive Chart >

Biglari Holdings Inc. Class B (BH) Company Bio

Biglari Holdings owns, operates, and franchises restaurants under restaurant concepts, including Steak n Shake. The company was founded in 1934 and is based in San Antonio, Texas.

Latest BH News From Around the Web

Below are the latest news stories about BIGLARI HOLDINGS INC that investors may wish to consider to help them evaluate BH as an investment opportunity.

BIGLARI HOLDINGS INC. NEWS RELEASEBiglari Holdings Inc. (NYSE: BH.A; BH) announces its results for the third quarter and first nine months of 2023. |

Biglari Holdings Inc. (NYSE:BH.A) is favoured by hedge funds owners who hold 66% of the companyKey Insights Institutions' substantial holdings in Biglari Holdings implies that they have significant influence over... |

20 Most Affordable Housing Markets in the US in 2023This article covers the 20 Most Affordable Housing Markets in the US in 2023 and provides an in-depth insight into cities that offer the most affordable housing in the US in the current year. For a quick overview of the top 5, read our article, the 5 Most Affordable Housing Markets in the US in […] |

Investors in Biglari Holdings (NYSE:BH.A) have seen respectable returns of 76% over the past three yearsBiglari Holdings Inc. ( NYSE:BH.A ) shareholders might be concerned after seeing the share price drop 14% in the last... |

CBRL: Song Of The South And The Persian BuffettWith the stock being so beat up heading into tomorrow morning’s report, anything decent could spur a relief rally. |

BH Price Returns

| 1-mo | 5.80% |

| 3-mo | -3.81% |

| 6-mo | 26.02% |

| 1-year | -1.94% |

| 3-year | 18.83% |

| 5-year | 114.59% |

| YTD | 20.64% |

| 2023 | 18.83% |

| 2022 | -2.64% |

| 2021 | 28.21% |

| 2020 | -2.81% |

| 2019 | 0.74% |

Continue Researching BH

Want to do more research on Biglari Holdings Inc's stock and its price? Try the links below:Biglari Holdings Inc (BH) Stock Price | Nasdaq

Biglari Holdings Inc (BH) Stock Quote, History and News - Yahoo Finance

Biglari Holdings Inc (BH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...