The Buckle Inc. (BKE): Price and Financial Metrics

BKE Price/Volume Stats

| Current price | $41.59 | 52-week high | $48.15 |

| Prev. close | $40.15 | 52-week low | $30.31 |

| Day low | $40.50 | Volume | 842,700 |

| Day high | $41.61 | Avg. volume | 414,081 |

| 50-day MA | $37.46 | Dividend yield | 3.51% |

| 200-day MA | $38.38 | Market Cap | 2.11B |

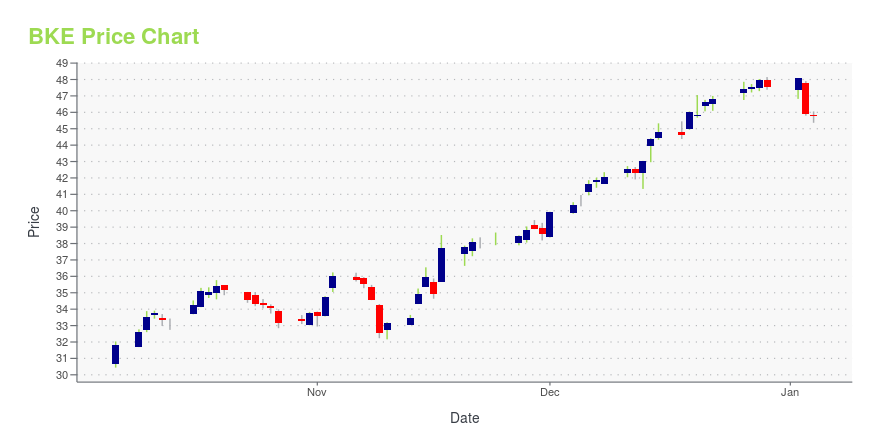

BKE Stock Price Chart Interactive Chart >

The Buckle Inc. (BKE) Company Bio

Buckle Inc. offers apparel, accessories, and footwear, catering to fashion-conscious young men and women. The company was founded in 1948 and is based in Kearney, Nebraska.

Latest BKE News From Around the Web

Below are the latest news stories about BUCKLE INC that investors may wish to consider to help them evaluate BKE as an investment opportunity.

What Is The Buckle, Inc.'s (NYSE:BKE) Share Price Doing?The Buckle, Inc. ( NYSE:BKE ), is not the largest company out there, but it led the NYSE gainers with a relatively... |

The Buckle, Inc. Announces a $2.50 Per Share Special Cash Dividend, a $0.35 Per Share Quarterly Dividend, and Leadership AppointmentsKEARNEY, Neb., December 05, 2023--THE BUCKLE, INC. ANNOUNCES A $2.50 PER SHARE SPECIAL CASH DIVIDEND, A $0.35 PER SHARE QUARTERLY DIVIDEND, AND LEADERSHIP APPOINTMENTS |

Retail and Autos in Focus: November Interim Sales TrendsA strong 3rd-quarter earnings season is in the books, and the focus turns to what near-term consumer shifts may be brewing |

The Buckle, Inc. Reports November 2023 Net SalesKEARNEY, Neb., November 30, 2023--The Buckle, Inc. Reports November 2023 Net Sales |

Shareholders Would Enjoy A Repeat Of Buckle's (NYSE:BKE) Recent Growth In ReturnsIf we want to find a stock that could multiply over the long term, what are the underlying trends we should look for... |

BKE Price Returns

| 1-mo | 13.23% |

| 3-mo | 10.70% |

| 6-mo | 14.25% |

| 1-year | 26.89% |

| 3-year | 38.33% |

| 5-year | 236.04% |

| YTD | -5.51% |

| 2023 | 15.02% |

| 2022 | 10.91% |

| 2021 | 69.97% |

| 2020 | 25.01% |

| 2019 | 55.19% |

BKE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BKE

Want to see what other sources are saying about Buckle Inc's financials and stock price? Try the links below:Buckle Inc (BKE) Stock Price | Nasdaq

Buckle Inc (BKE) Stock Quote, History and News - Yahoo Finance

Buckle Inc (BKE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...