BlackRock Inc. (BLK): Price and Financial Metrics

BLK Price/Volume Stats

| Current price | $1,111.46 | 52-week high | $1,112.13 |

| Prev. close | $1,101.64 | 52-week low | $773.74 |

| Day low | $1,098.44 | Volume | 661,800 |

| Day high | $1,112.13 | Avg. volume | 788,034 |

| 50-day MA | $995.61 | Dividend yield | 1.89% |

| 200-day MA | $984.35 | Market Cap | 172.19B |

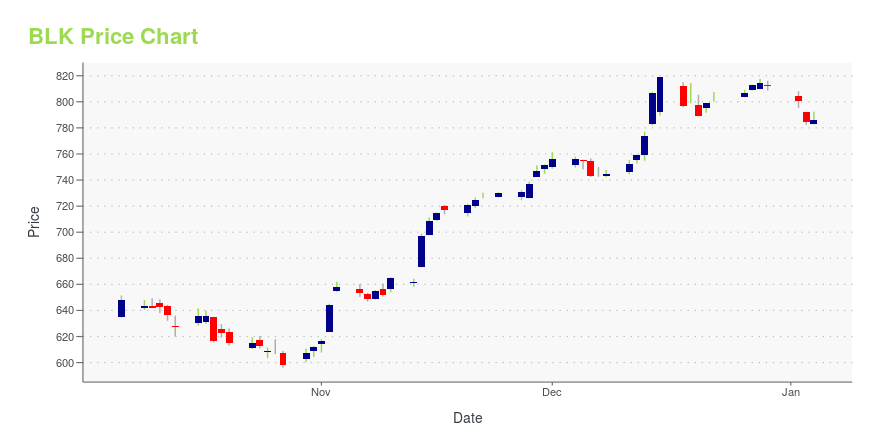

BLK Stock Price Chart Interactive Chart >

BlackRock Inc. (BLK) Company Bio

BlackRock, Inc. is an American multinational investment management corporation based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with over $8 trillion in assets under management as of January 2021. BlackRock operates globally with 70 offices in 30 countries and clients in 100 countries. (Source:Wikipedia)

BLK Price Returns

| 1-mo | 14.37% |

| 3-mo | 29.06% |

| 6-mo | 12.83% |

| 1-year | 38.69% |

| 3-year | 100.94% |

| 5-year | 122.43% |

| YTD | 9.60% |

| 2024 | 29.92% |

| 2023 | 17.86% |

| 2022 | -20.40% |

| 2021 | 29.39% |

| 2020 | 47.21% |

BLK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BLK

Want to do more research on BlackRock Inc's stock and its price? Try the links below:BlackRock Inc (BLK) Stock Price | Nasdaq

BlackRock Inc (BLK) Stock Quote, History and News - Yahoo Finance

BlackRock Inc (BLK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...