Bellerophon Therapeutics, Inc. (BLPH): Price and Financial Metrics

BLPH Price/Volume Stats

| Current price | $0.06 | 52-week high | $11.15 |

| Prev. close | $0.05 | 52-week low | $0.03 |

| Day low | $0.05 | Volume | 10,100 |

| Day high | $0.06 | Avg. volume | 60,635 |

| 50-day MA | $0.05 | Dividend yield | N/A |

| 200-day MA | $0.19 | Market Cap | 672.82K |

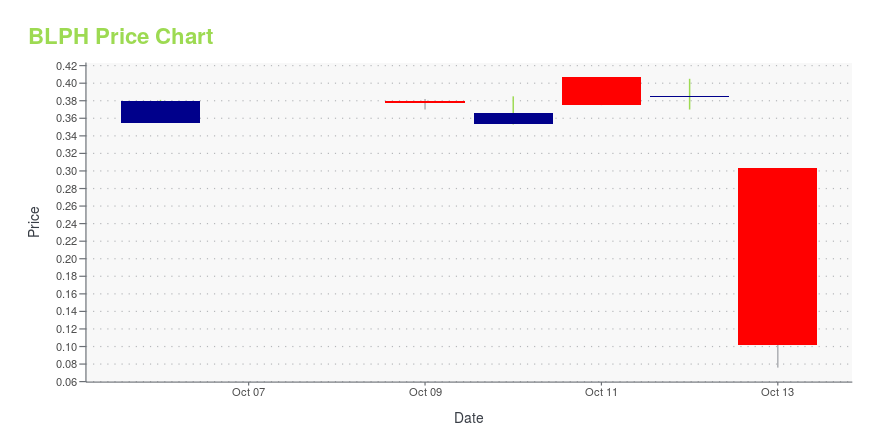

BLPH Stock Price Chart Interactive Chart >

Bellerophon Therapeutics, Inc. (BLPH) Company Bio

Bellerophon Therapeutics, Inc., a clinical-stage therapeutics company, focuses on the development of products at the intersection of drugs and devices that address unmet medical needs in the treatment of cardiopulmonary diseases. Its product candidates are INOpulse, a pulsatile nitric oxide delivery device, which is in Phase III clinical trials for the treatment of pulmonary arterial hypertension; and in Phase II clinical trials to treat pulmonary hypertension associated with chronic obstructive pulmonary diseases and pulmonary hypertension associated with idiopathic pulmonary fibrosis. Bellerophon Therapeutics, Inc. was founded in 2009 and is founded in Warren, New Jersey.

Latest BLPH News From Around the Web

Below are the latest news stories about BELLEROPHON THERAPEUTICS INC that investors may wish to consider to help them evaluate BLPH as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting off the day with a breakdown of all the biggest pre-market stock movers traders need to know about on Friday! |

Why Is Bellerophon Therapeutics (BLPH) Stock Down 34% Today?Bellerophon Therapeutics (BLPH) stock is losing value on Tuesday after the clinical-stage therapeutics company was sent a delisting notice. |

Biogen Layoffs 2023: What to Know About the Latest BIIB Job CutsBiogen (BIIB) layoffs are on the way as the company seeks further profits with its upcoming Alzheimer's disease drug launch. |

MBLY Stock Alert: Morgan Stanley Restarts Mobileye CoverageMobileye (MBLY) stock is on the move Tuesday after Morgan Stanley analyst Adam Jonas renewed coverage of the company's shares. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another dive into the biggest pre-market stock movers as we check out the most recent news for Tuesday morning! |

BLPH Price Returns

| 1-mo | 5.63% |

| 3-mo | -1.64% |

| 6-mo | 66.67% |

| 1-year | -99.21% |

| 3-year | -98.68% |

| 5-year | -99.37% |

| YTD | 62.16% |

| 2023 | -95.89% |

| 2022 | -70.97% |

| 2021 | -53.52% |

| 2020 | 27.16% |

| 2019 | -56.29% |

Loading social stream, please wait...