Bank of Hawaii Corporation (BOH): Price and Financial Metrics

BOH Price/Volume Stats

| Current price | $69.13 | 52-week high | $75.19 |

| Prev. close | $68.64 | 52-week low | $45.56 |

| Day low | $68.70 | Volume | 280,250 |

| Day high | $69.96 | Avg. volume | 322,317 |

| 50-day MA | $59.32 | Dividend yield | 4.1% |

| 200-day MA | $60.20 | Market Cap | 2.74B |

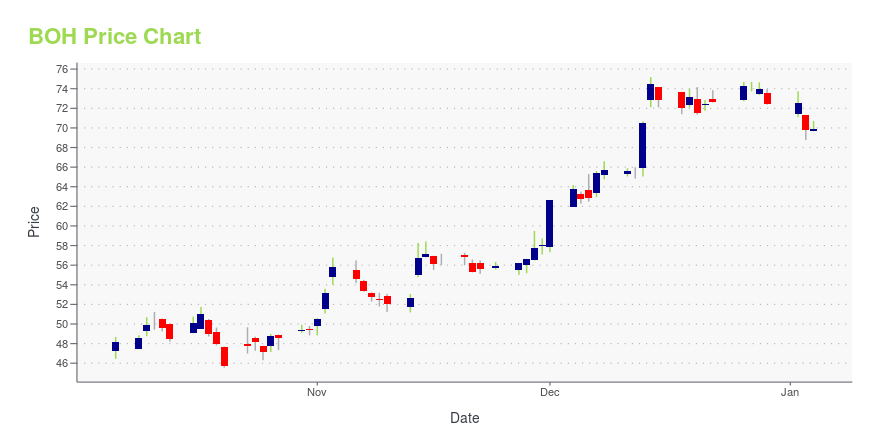

BOH Stock Price Chart Interactive Chart >

Bank of Hawaii Corporation (BOH) Company Bio

Bank of Hawaii provides financial services and products in Hawaii, Guam, and other Pacific Islands. The company operates through Retail Banking, Commercial Banking, Investment Services, and Treasury and Other segments. The company was founded in 1897 and is based in Honolulu, Hawaii.

Latest BOH News From Around the Web

Below are the latest news stories about BANK OF HAWAII CORP that investors may wish to consider to help them evaluate BOH as an investment opportunity.

Investors in Bank of Hawaii (NYSE:BOH) have seen decent returns of 33% over the past five yearsIf you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to... |

7 Short-Squeeze Stocks That Are Screaming for SpeculationWhile the concept of short-squeeze stocks has been all the rage throughout most of the pandemic-disruption cycle, we may have been doing this all wrong. |

What Makes Bank of Hawaii Corporation (BOH) a Good Short Position?Diamond Hill Capital, an investment management company, released its “Long-Short Fund” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The positive returns of the portfolio outperformed the Russell 1000 Index and the blended benchmark (60% Russell 1000 Index/40% Bloomberg US Treasury Bills 1-3 Month Index), both of which were negative in […] |

Strength Seen in Bank of Hawaii (BOH): Can Its 5.6% Jump Turn into More Strength?Bank of Hawaii (BOH) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term. |

Is It Worth Considering Bank of Hawaii Corporation (NYSE:BOH) For Its Upcoming Dividend?Bank of Hawaii Corporation ( NYSE:BOH ) is about to trade ex-dividend in the next four days. The ex-dividend date is... |

BOH Price Returns

| 1-mo | 22.22% |

| 3-mo | 20.85% |

| 6-mo | 10.63% |

| 1-year | 30.68% |

| 3-year | -5.08% |

| 5-year | 0.26% |

| YTD | -1.07% |

| 2023 | -1.51% |

| 2022 | -4.11% |

| 2021 | 12.82% |

| 2020 | -16.31% |

| 2019 | 45.86% |

BOH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BOH

Here are a few links from around the web to help you further your research on Bank Of Hawaii Corp's stock as an investment opportunity:Bank Of Hawaii Corp (BOH) Stock Price | Nasdaq

Bank Of Hawaii Corp (BOH) Stock Quote, History and News - Yahoo Finance

Bank Of Hawaii Corp (BOH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...