BP PLC ADR (BP): Price and Financial Metrics

BP Price/Volume Stats

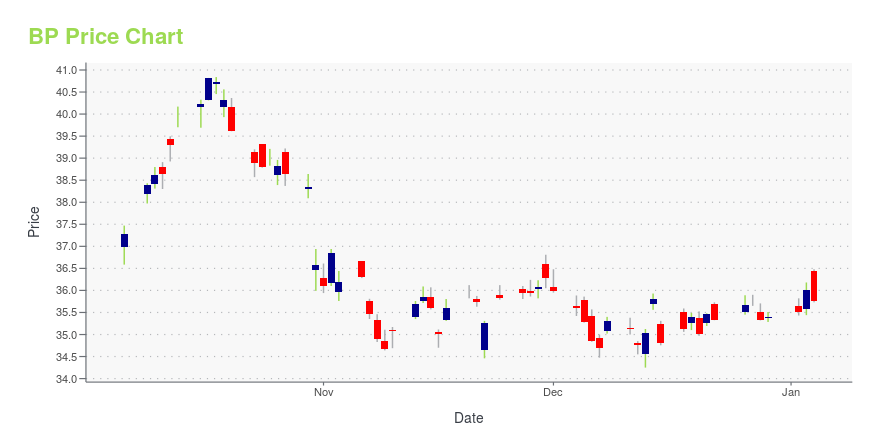

| Current price | $35.25 | 52-week high | $40.84 |

| Prev. close | $35.18 | 52-week low | $33.52 |

| Day low | $34.96 | Volume | 7,135,519 |

| Day high | $35.42 | Avg. volume | 8,559,661 |

| 50-day MA | $35.96 | Dividend yield | 4.94% |

| 200-day MA | $36.53 | Market Cap | 97.65B |

BP Stock Price Chart Interactive Chart >

BP PLC ADR (BP) Company Bio

BP PLC, formerly British Petroleum, is an integrated oil and gas company. Founded by William Knox D'Arcy in the early 1900’s, the company’s current business activities involved oil and natural gas exploration, midstream transportation, supply and trading of crude oil, petrochemicals products and related services to wholesale and retail customers. The company primarily operates in two segments, upstream and downstream. The upstream segment relates to BP’s oil exploration and production while the downstream segment consists of the company’s consumer products and services. BP’s Chief Executive Officer is Bernard Looney and the company’s global headquarters is located in London, England. BP employs over 70,000 people worldwide and its chief competitors include ExxonMobil Corp. (XOM), Valero Energy Corp. (VLO), and Chevron Corp. (CVX).

Latest BP News From Around the Web

Below are the latest news stories about BP PLC that investors may wish to consider to help them evaluate BP as an investment opportunity.

The Last Fallen Angel For 2024BP p.l.c. is the quintessential oil and gas company that has taken good care of shareholders but has fallen 26.71% over the past 10 years. |

12 Best Foreign Stocks With DividendsIn this article, we will take a detailed look at the 12 Best Foreign Stocks With Dividends. For a quick overview of such stocks, read our article 5 Best Foreign Stocks With Dividends. While markets are roaring amid the Fed’s indication that it’s ready to begin interest rate cuts next year, some analysts still advise caution and […] |

What Shipping and Energy Companies Are Doing About Red Sea Chaos(Bloomberg) -- More than a hundred container ships are taking the long route around Africa to avoid violence in the Red Sea, according to Kuehne+Nagel. Maersk said it could take a few weeks for a task force to be fully operational.Most Read from BloombergHyperloop One to Shut Down After Failing to Reinvent TransitOpenAI Is in Talks to Raise New Funding at Valuation of $100 Billion or MoreSupreme Court Refuses to Fast-Track Trump Immunity ClashTencent Leads $80 Billion Rout as China Rekindles Cra |

7 Climate Change Stocks With Hot Potential for 2024Wager on these top climate change stocks poised for profit in the eco-trend boom amidst a global push for sustainability |

TotalEnergies (TTE) Signs Two Solar CPPA With LyondellBasellTotalEnergies (TTE) continues to supply clean electricity generated in the United States to its industrial customers through a Corporate Power Purchase Agreement and assist in cutting emissions. |

BP Price Returns

| 1-mo | -1.32% |

| 3-mo | -9.66% |

| 6-mo | 1.30% |

| 1-year | 0.84% |

| 3-year | 66.43% |

| 5-year | 18.19% |

| YTD | 1.95% |

| 2023 | 5.94% |

| 2022 | 36.98% |

| 2021 | 36.28% |

| 2020 | -41.36% |

| 2019 | 5.78% |

BP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BP

Want to see what other sources are saying about Bp Plc's financials and stock price? Try the links below:Bp Plc (BP) Stock Price | Nasdaq

Bp Plc (BP) Stock Quote, History and News - Yahoo Finance

Bp Plc (BP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...