Popular, Inc. (BPOP): Price and Financial Metrics

BPOP Price/Volume Stats

| Current price | $102.78 | 52-week high | $105.01 |

| Prev. close | $102.21 | 52-week low | $59.27 |

| Day low | $101.11 | Volume | 410,296 |

| Day high | $104.89 | Avg. volume | 395,264 |

| 50-day MA | $90.29 | Dividend yield | 2.41% |

| 200-day MA | $82.38 | Market Cap | 7.43B |

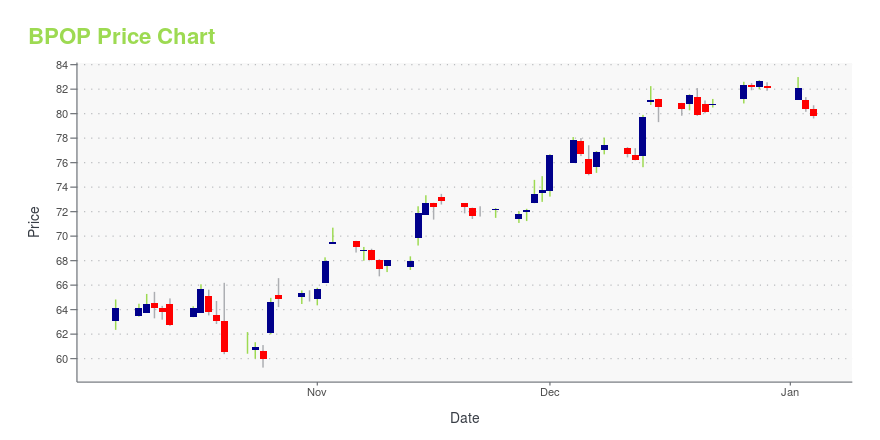

BPOP Stock Price Chart Interactive Chart >

Popular, Inc. (BPOP) Company Bio

Popular Inc. provides various retail and commercial banking products and services primarily to institutional and retail customers in Puerto Rico and the U.S. The company was founded in 1893 and is based in Hato Rey, Puerto Rico.

Latest BPOP News From Around the Web

Below are the latest news stories about POPULAR INC that investors may wish to consider to help them evaluate BPOP as an investment opportunity.

Popular Announces Retirement of Chief Financial Officer, Carlos J. Vázquez, and names Jorge J. García as SuccessorSAN JUAN, Puerto Rico, December 11, 2023--Popular, Inc. ("Popular" or the "Corporation") (NASDAQ: BPOP) announced today that Carlos J. Vázquez will retire effective March 31, 2024 after serving as Chief Financial Officer ("CFO") since 2013, and in other senior leadership positions since joining Popular in 1997. He will be succeeded by Jorge J. García, currently Corporate Comptroller and Chief Accounting Officer. |

Popular Inc's Dividend AnalysisPopular Inc (NASDAQ:BPOP) recently announced a dividend of $0.62 per share, payable on 2024-01-02, with the ex-dividend date set for 2023-12-06. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Popular Inc's dividend performance and assess its sustainability. |

Popular, Inc. Declares Dividend on Preferred Stock and Announces Distribution on Trust Preferred SecuritiesSAN JUAN, Puerto Rico, December 04, 2023--Popular, Inc. (NASDAQ: BPOP) announced today that it has declared the following monthly cash dividend on its outstanding shares of Non-Cumulative Monthly Income Preferred Stock: |

Banco Popular De Puerto Rico Named "Bank of the Year Puerto Rico" by The Banker MagazineSAN JUAN, Puerto Rico, December 01, 2023--Banco Popular de Puerto Rico was selected as "Bank of the Year Puerto Rico" by The Banker, The Financial Times’ international banking magazine. |

Popular (NASDAQ:BPOP) Could Be A Buy For Its Upcoming DividendPopular, Inc. ( NASDAQ:BPOP ) stock is about to trade ex-dividend in four days. The ex-dividend date is usually set to... |

BPOP Price Returns

| 1-mo | 19.39% |

| 3-mo | 19.56% |

| 6-mo | 19.01% |

| 1-year | 50.00% |

| 3-year | 54.20% |

| 5-year | 106.11% |

| YTD | 27.06% |

| 2023 | 28.33% |

| 2022 | -16.78% |

| 2021 | 49.06% |

| 2020 | 0.00% |

| 2019 | 27.21% |

BPOP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BPOP

Want to see what other sources are saying about Popular Inc's financials and stock price? Try the links below:Popular Inc (BPOP) Stock Price | Nasdaq

Popular Inc (BPOP) Stock Quote, History and News - Yahoo Finance

Popular Inc (BPOP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...