Sierra Bancorp (BSRR): Price and Financial Metrics

BSRR Price/Volume Stats

| Current price | $29.71 | 52-week high | $31.85 |

| Prev. close | $30.16 | 52-week low | $16.75 |

| Day low | $28.62 | Volume | 81,779 |

| Day high | $30.02 | Avg. volume | 30,028 |

| 50-day MA | $22.72 | Dividend yield | 3.1% |

| 200-day MA | $20.41 | Market Cap | 433.65M |

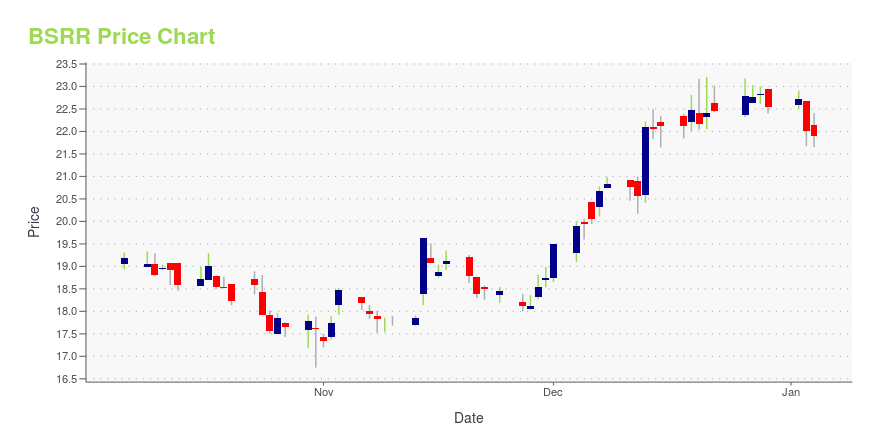

BSRR Stock Price Chart Interactive Chart >

Sierra Bancorp (BSRR) Company Bio

Sierra Bancorp provides a range of retail and commercial banking services to communities in the central and southern regions of the San Joaquin Valley in California. The company was founded in 1977 and is based in Porterville, California.

Latest BSRR News From Around the Web

Below are the latest news stories about SIERRA BANCORP that investors may wish to consider to help them evaluate BSRR as an investment opportunity.

Sierra Bancorp (NASDAQ:BSRR) Could Be A Buy For Its Upcoming DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Sierra Bancorp (BSRR) Q3 Earnings: Taking a Look at Key Metrics Versus EstimatesWhile the top- and bottom-line numbers for Sierra Bancorp (BSRR) give a sense of how the business performed in the quarter ended September 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values. |

Sierra Bancorp's (NASDAQ:BSRR) Dividend Will Be $0.23Sierra Bancorp ( NASDAQ:BSRR ) has announced that it will pay a dividend of $0.23 per share on the 14th of November... |

Sierra Bancorp (BSRR) Reports Solid Q3 2023 Earnings and Year-to-Date Financial PerformanceCompany's net income for Q3 2023 stands at $9.9 million, with $28.5 million for the first nine months of 2023 |

Sierra Bancorp (BSRR) Misses Q3 Earnings EstimatesSierra Bancorp (BSRR) delivered earnings and revenue surprises of -1.45% and 0.05%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

BSRR Price Returns

| 1-mo | 42.29% |

| 3-mo | 46.57% |

| 6-mo | 38.66% |

| 1-year | 44.79% |

| 3-year | 38.60% |

| 5-year | 38.97% |

| YTD | 34.66% |

| 2023 | 11.45% |

| 2022 | -18.58% |

| 2021 | 17.55% |

| 2020 | -14.70% |

| 2019 | 24.58% |

BSRR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BSRR

Want to see what other sources are saying about Sierra Bancorp's financials and stock price? Try the links below:Sierra Bancorp (BSRR) Stock Price | Nasdaq

Sierra Bancorp (BSRR) Stock Quote, History and News - Yahoo Finance

Sierra Bancorp (BSRR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...