BioXcel Therapeutics, Inc. (BTAI): Price and Financial Metrics

BTAI Price/Volume Stats

| Current price | $1.15 | 52-week high | $10.43 |

| Prev. close | $1.17 | 52-week low | $1.04 |

| Day low | $1.13 | Volume | 259,600 |

| Day high | $1.20 | Avg. volume | 1,006,652 |

| 50-day MA | $1.43 | Dividend yield | N/A |

| 200-day MA | $2.70 | Market Cap | 43.16M |

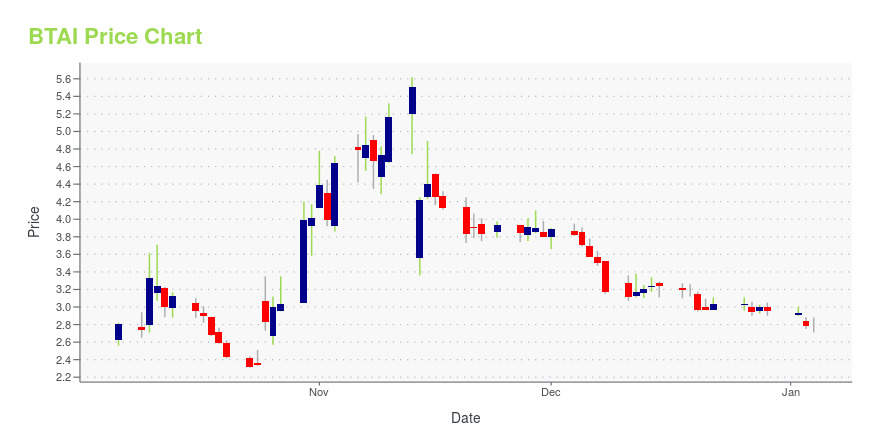

BTAI Stock Price Chart Interactive Chart >

BioXcel Therapeutics, Inc. (BTAI) Company Bio

BioXcel Therapeutics, Inc., a clinical stage biopharmaceutical company, focuses on novel artificial intelligence-based drug development in the fields of neuroscience and immuno-oncology in the United States. The company is involved in developing BXCL501, a sublingual thin film formulation of dexmedetomidine designed for acute treatment of agitation resulting from neurological and psychiatric disorders; and BXCL701, an immuno-oncology agent designed for the treatment of prostate and pancreatic cancers. It is also developing BXCL502, a novel approach to the treatment of symptoms resulting from neurological disorders; and BXCL702, an immuno-oncology agent for hematological malignancies. The company was founded in 2017 and is based in Branford, Connecticut. BioXcel Therapeutics, Inc. is a subsidiary of BioXcel Corporation.

Latest BTAI News From Around the Web

Below are the latest news stories about BIOXCEL THERAPEUTICS INC that investors may wish to consider to help them evaluate BTAI as an investment opportunity.

BioXcel Therapeutics Hosting Virtual Neuroscience R&D Day TodayCompany to review BXCL502 and other potential emerging pipeline candidates Dr. Jeffrey Cummings to discuss agitation relief in Alzheimer’s disease and BXCL502 as a potential treatment for chronic use Dr. Sandra Comer to discuss BXCL501 as a potential treatment for opioid withdrawal NEW HAVEN, Conn., Dec. 12, 2023 (GLOBE NEWSWIRE) -- As previously announced, BioXcel Therapeutics, Inc. (Nasdaq: BTAI), a biopharmaceutical company utilizing artificial intelligence approaches to develop transformativ |

BioXcel Therapeutics Strengthens Clinical Development Leadership to Advance Late-Stage ProgramsVincent J. O’Neill, M.D., promoted to Executive Vice President, Chief of Product Development and Medical Officer Rajiv Patni, M.D., appointed Strategic Clinical Advisor to CEO and Board of Directors NEW HAVEN, Conn., Dec. 11, 2023 (GLOBE NEWSWIRE) -- BioXcel Therapeutics, Inc. (Nasdaq: BTAI), a biopharmaceutical company utilizing artificial intelligence to develop transformative medicines in neuroscience and immuno-oncology, today announced a key executive promotion and a clinical advisor appoin |

Micro/Small Cap Companies Using AI In Drug Discovery Up 35% In NovemberThe AI method is up to 250 times more efficient than the traditional method of drug discovery. reducing timelines for drug discovery, increasing accuracy of efficacy and safety predictions. |

BioXcel Therapeutics to Host Virtual Neuroscience R&D Day on Dec. 12, 2023Company to review BXCL502 and other potential emerging pipeline candidates Dr. Jeffrey Cummings to discuss agitation relief in Alzheimer’s disease and BXCL502 as a potential treatment Dr. Sandra Comer to discuss BXCL501 as a potential treatment for opioid withdrawal NEW HAVEN, Conn., Nov. 30, 2023 (GLOBE NEWSWIRE) -- BioXcel Therapeutics, Inc. (Nasdaq: BTAI), a biopharmaceutical company utilizing artificial intelligence approaches to develop transformative medicines in neuroscience and immuno-on |

7 Penny Stocks With Low Floats and High Short InterestIs the 'smart money' on the money shorting these low-float penny stocks, or is there the opportunity for a short squeeze? |

BTAI Price Returns

| 1-mo | -12.88% |

| 3-mo | -56.27% |

| 6-mo | -65.26% |

| 1-year | -87.91% |

| 3-year | -95.45% |

| 5-year | -89.55% |

| YTD | -61.02% |

| 2023 | -86.27% |

| 2022 | 5.66% |

| 2021 | -56.00% |

| 2020 | 216.22% |

| 2019 | 278.50% |

Loading social stream, please wait...