Anheuser-Busch InBev S.A. ADR (BUD): Price and Financial Metrics

BUD Price/Volume Stats

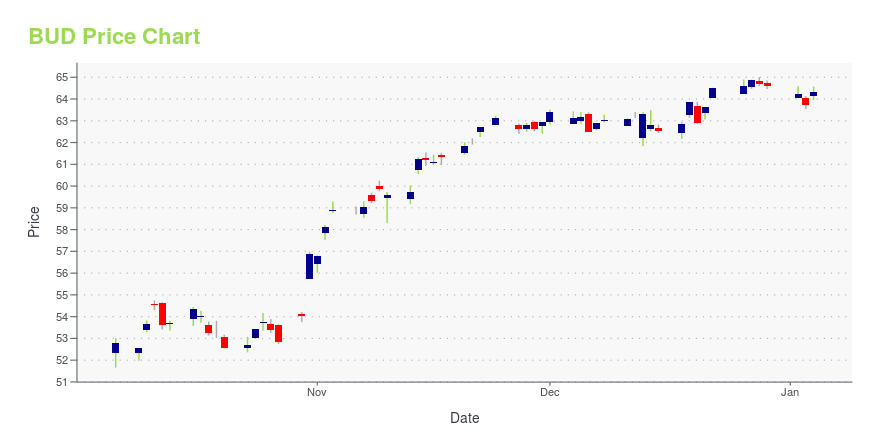

| Current price | $61.38 | 52-week high | $67.49 |

| Prev. close | $60.70 | 52-week low | $51.66 |

| Day low | $60.85 | Volume | 1,076,419 |

| Day high | $61.40 | Avg. volume | 1,781,476 |

| 50-day MA | $61.51 | Dividend yield | 1.08% |

| 200-day MA | $61.14 | Market Cap | 110.31B |

BUD Stock Price Chart Interactive Chart >

Anheuser-Busch InBev S.A. ADR (BUD) Company Bio

Anheuser Busch InBev is the global leader in the production, distribution, and sale of beer, alcoholic beverages, and soft drinks worldwide. The company was founded in 1366 and is based in Leuven, Belgium.

Latest BUD News From Around the Web

Below are the latest news stories about ANHEUSER-BUSCH INBEV SA that investors may wish to consider to help them evaluate BUD as an investment opportunity.

17 Countries With Best Universities In EuropeIn this article, we will be looking at the 17 countries with the best universities in Europe. If you want to skip our detailed analysis of the global textile market, you can go directly to 5 Countries With Best Universities In Europe. Employment Trends in Europe: An Overview The European job market is changing swiftly. […] |

24 States that Legalized Recreational Weed in the USIn this article, we are going to discuss the 24 states that legalized recreational weed in the US. You can skip our detailed analysis of the cannabis industry in America, the effect of legalization on prices, and the fastest growing category in the cannabis industry, and go directly to 5 States that Legalized Recreational Weed in […] |

The Bud Light Boycott Was Just the Beginning of a Crazy Year for BeerA Bud Light boycott in 2023 reshuffled the beer industry, vaulting Modelo Especial to the top spot in America. At the same time, many people simply stopped drinking beer altogether. |

Brazilian Billionaire Marcel Telles Hands Stake in World’s Biggest Brewer to Son(Bloomberg) -- Marcel Telles, the billionaire Brazilian investor who cofounded buyout firm 3G Capital Inc., donated his stake in brewer Anheuser-Busch InBev SA to his son Max in a major step toward succession planning.Most Read from BloombergChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerTesla Plans Revamp of Smash Hit Model Y From China PlantApple’s iPhone Design Chief Enlisted by Jony Ive, Sam Altman to Work on AI DevicesGhost Ships at Reawakened North Korea Port Put Ukraine |

New Bud Light backlash follows Kid Rock's commentsKid Rock started the Bud Light boycott. Instead, he declared his displeasure at the Anheuser-Busch InBev brand the way any rational person would. Without explicitly saying so, the "Cowboy" and "All Summer Long" singer was very angry that the beer brand had a minor partnership with the transgender influencer Dylan Mulvaney. |

BUD Price Returns

| 1-mo | 3.19% |

| 3-mo | 3.41% |

| 6-mo | -0.05% |

| 1-year | 6.74% |

| 3-year | -8.17% |

| 5-year | -35.83% |

| YTD | -3.97% |

| 2023 | 8.67% |

| 2022 | -0.14% |

| 2021 | -12.85% |

| 2020 | -14.17% |

| 2019 | 26.90% |

BUD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BUD

Here are a few links from around the web to help you further your research on Anheuser-Busch InBev SA's stock as an investment opportunity:Anheuser-Busch InBev SA (BUD) Stock Price | Nasdaq

Anheuser-Busch InBev SA (BUD) Stock Quote, History and News - Yahoo Finance

Anheuser-Busch InBev SA (BUD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...