China Automotive Systems, Inc. (CAAS): Price and Financial Metrics

CAAS Price/Volume Stats

| Current price | $4.61 | 52-week high | $5.64 |

| Prev. close | $4.53 | 52-week low | $3.04 |

| Day low | $4.25 | Volume | 139,076 |

| Day high | $4.69 | Avg. volume | 51,161 |

| 50-day MA | $3.79 | Dividend yield | N/A |

| 200-day MA | $3.51 | Market Cap | 139.16M |

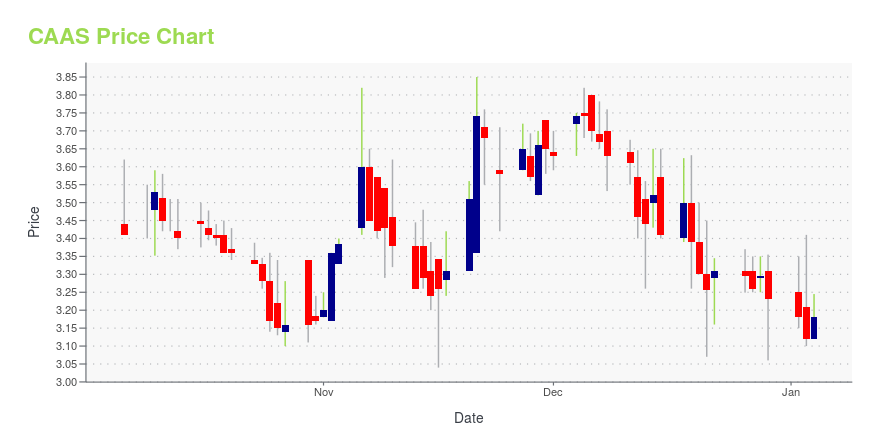

CAAS Stock Price Chart Interactive Chart >

China Automotive Systems, Inc. (CAAS) Company Bio

China Automotive Systems, Inc. manufactures and sells automotive systems and components in China. The company was founded in 2003 and is based in Jing Zhou, China.

Latest CAAS News From Around the Web

Below are the latest news stories about CHINA AUTOMOTIVE SYSTEMS INC that investors may wish to consider to help them evaluate CAAS as an investment opportunity.

China Automotive Systems, Inc. (NASDAQ:CAAS) Q3 2023 Earnings Call TranscriptChina Automotive Systems, Inc. (NASDAQ:CAAS) Q3 2023 Earnings Call Transcript November 10, 2023 Operator: Good morning, everyone, and welcome to the China Automotive Systems’ Third Quarter 2023 Conference Call. At this time, all participants are in a listen-only mode and the floor will be open for questions after the presentation. [Operator Instructions] Please note, this […] |

China Automotive Systems Reports a 29.2% Increase in Diluted Earnings Per Share Growth in the Third Quarter of 2023China Automotive Systems, Inc. (Nasdaq: CAAS) ("CAAS" or the "Company"), a leading power steering components and systems supplier in China, today announced its unaudited financial results for the third quarter and nine months ended September 30, 2023. |

China Automotive Systems to Announce Unaudited 2023 Third Quarter Financial Results on November 10, 2023China Automotive Systems, Inc. (Nasdaq: CAAS) ("CAAS" or the "Company"), a leading power steering components and systems supplier in China, today announced that it will issue unaudited financial results for the third quarter ended September 30, 2023 on Friday, November 10, 2023, before the market opens. Management will conduct a conference call on November 10th at 8:00 A.M. EST/9:00 P.M. Beijing Time to discuss these results. A question and answer session will follow management's presentation. |

11 Cheap Chinese Penny Stocks to Buy According to Hedge FundsIn this article, we will take a look at the 11 cheap Chinese penny stocks to buy according to hedge funds. To see more such companies, go directly to 5 Cheap Chinese Penny Stocks to Buy According to Hedge Funds. Chinese stocks rebounded this year amid a boom in tourism-related revenue and on hopes that the […] |

The one-year underlying earnings growth at China Automotive Systems (NASDAQ:CAAS) is promising, but the shareholders are still in the red over that timeThe simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do... |

CAAS Price Returns

| 1-mo | 22.93% |

| 3-mo | 30.59% |

| 6-mo | 28.06% |

| 1-year | -9.96% |

| 3-year | 15.54% |

| 5-year | 111.47% |

| YTD | 42.72% |

| 2023 | -44.31% |

| 2022 | 116.42% |

| 2021 | -57.05% |

| 2020 | 98.10% |

| 2019 | 29.10% |

Continue Researching CAAS

Want to do more research on China Automotive Systems Inc's stock and its price? Try the links below:China Automotive Systems Inc (CAAS) Stock Price | Nasdaq

China Automotive Systems Inc (CAAS) Stock Quote, History and News - Yahoo Finance

China Automotive Systems Inc (CAAS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...