Cango Inc. ADR (CANG): Price and Financial Metrics

CANG Price/Volume Stats

| Current price | $1.91 | 52-week high | $2.08 |

| Prev. close | $1.94 | 52-week low | $0.92 |

| Day low | $1.88 | Volume | 20,400 |

| Day high | $1.95 | Avg. volume | 55,539 |

| 50-day MA | $1.72 | Dividend yield | N/A |

| 200-day MA | $1.37 | Market Cap | 208.03M |

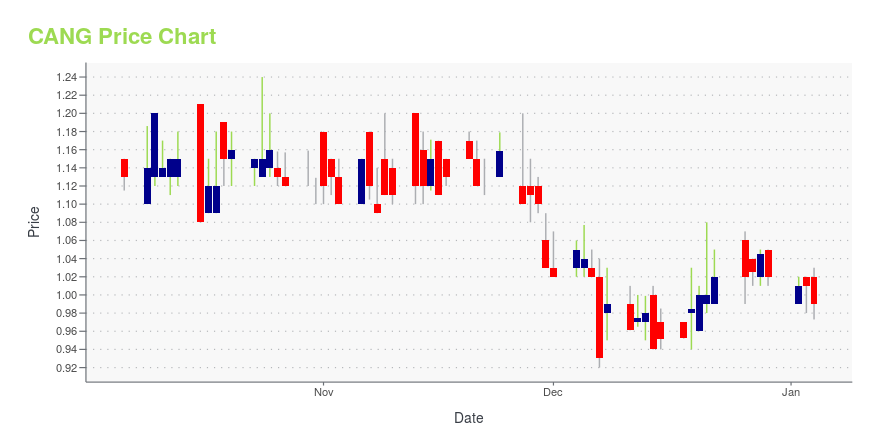

CANG Stock Price Chart Interactive Chart >

Cango Inc. ADR (CANG) Company Bio

Cango Inc. operates an automotive transaction service platform that connects dealers, financial institutions, car buyers, and other industry participants in the People’s Republic of China. It facilitates automotive financing services that include facilitating financing transactions from financial institutions to car buyers; automotive transactions between automotive wholesalers, dealers, and car buyers; and after-market services to car buyers. The company was founded in 2010 and is based in Shanghai, China.

Latest CANG News From Around the Web

Below are the latest news stories about CANGO INC that investors may wish to consider to help them evaluate CANG as an investment opportunity.

Investors Aren't Entirely Convinced By Cango Inc.'s (NYSE:CANG) RevenuesIt's not a stretch to say that Cango Inc.'s ( NYSE:CANG ) price-to-sales (or "P/S") ratio of 0.4x seems quite... |

Cango Inc. (NYSE:CANG) Q3 2023 Earnings Call TranscriptCango Inc. (NYSE:CANG) Q3 2023 Earnings Call Transcript November 28, 2023 Operator: Good morning and good evening, everyone. Welcome to Cango Inc’s Third Quarter 2023 Earnings Conference Call. [Operator Instructions] This call is also being broadcast live on the company’s IR website. Joining us today are Mr. Jiayuan Lin, Chief Executive Officer; and Mr. Yongyi […] |

Cango Inc. Reports Third Quarter 2023 Unaudited Financial ResultsCango Inc. (NYSE: CANG) ("Cango" or the "Company"), a leading automotive transaction service platform in China, today announced its unaudited financial results for the third quarter of 2023. |

Cango Inc. to Report Third Quarter 2023 Financial Results on November 27, 2023 Eastern TimeCango Inc. (NYSE: CANG) ("Cango" or the "Company"), a leading automotive transaction service platform in China, today announced that it plans to release its third quarter 2023 financial results after the market closes on Monday, November 27, 2023. The earnings release will be available on the Company's investor relations website at http://ir.cangoonline.com/. |

Cango Inc. (NYSE:CANG) most popular amongst individual investors who own 51%, insiders hold 28%Key Insights Significant control over Cango by individual investors implies that the general public has more power to... |

CANG Price Returns

| 1-mo | 16.46% |

| 3-mo | 32.64% |

| 6-mo | 67.53% |

| 1-year | 44.70% |

| 3-year | -54.20% |

| 5-year | -65.16% |

| YTD | 87.25% |

| 2023 | -22.02% |

| 2022 | -58.34% |

| 2021 | -50.30% |

| 2020 | -20.03% |

| 2019 | 15.24% |

Continue Researching CANG

Want to do more research on Cango Inc's stock and its price? Try the links below:Cango Inc (CANG) Stock Price | Nasdaq

Cango Inc (CANG) Stock Quote, History and News - Yahoo Finance

Cango Inc (CANG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...