Chubb Ltd. (CB): Price and Financial Metrics

CB Price/Volume Stats

| Current price | $270.06 | 52-week high | $275.41 |

| Prev. close | $261.61 | 52-week low | $198.10 |

| Day low | $262.55 | Volume | 1,653,201 |

| Day high | $270.63 | Avg. volume | 1,651,241 |

| 50-day MA | $262.23 | Dividend yield | 1.38% |

| 200-day MA | $243.17 | Market Cap | 109.66B |

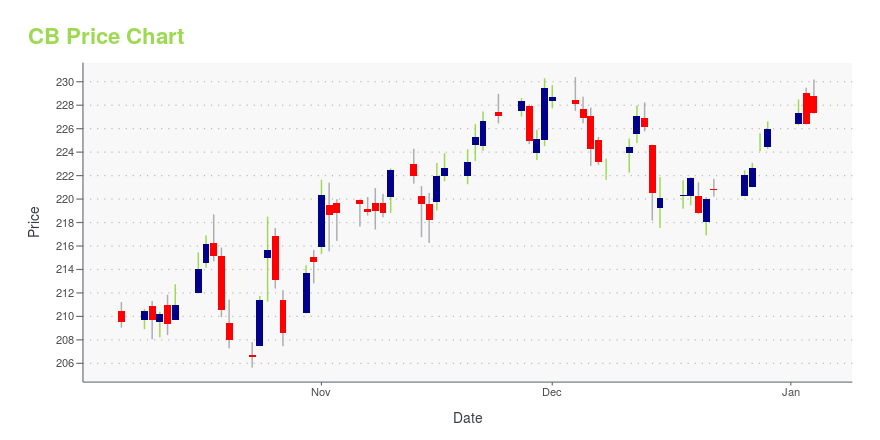

CB Stock Price Chart Interactive Chart >

Chubb Ltd. (CB) Company Bio

Chubb Limited, incorporated in Zürich, Switzerland, is the parent company of Chubb, a global provider of insurance products covering property and casualty, accident and health, reinsurance, and life insurance and the largest publicly traded property and casualty company in the world. Chubb operates in 55 countries and territories and in the Lloyd's insurance market in London. Clients of Chubb consist of multinational corporations and local businesses, individuals, and insurers seeking reinsurance coverage. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance.(Source:Wikipedia)

Latest CB News From Around the Web

Below are the latest news stories about CHUBB LTD that investors may wish to consider to help them evaluate CB as an investment opportunity.

CB or PGR: Which P&C Insurer Should You Buy for Higher Returns?Let's see how Chubb (CB) and Progressive (PGR) fare in terms of some of the key metrics. |

15 Best Group Insurance Companies Heading into 2024In this article, we will look into the 15 best group insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Group Insurance Companies Heading into 2024. Group Health Insurance Market According to a report by Allied Market Research, the global group health insurance […] |

Why CNO Financial (CNO) Deserves a Spot in Your PortfolioCNO Financial's (CNO) sustained growth in insurance policy income serves as a significant positive momentum for the company. |

Analyzing AON's $13.4B NFP Acquisition Deal, Stock DeclinesAON expects more than $60 million in cost synergies from the NFP acquisition deal. |

HCI Group (HCI) Affiliate TypTap Surpasses $1B In-Force PremiumHCI Group's (HCI) TypTap assumes around 6,800 policies from the first transfer from Florida's Citizens Property Insurance Corporation. |

CB Price Returns

| 1-mo | 3.87% |

| 3-mo | 10.41% |

| 6-mo | 12.71% |

| 1-year | 29.76% |

| 3-year | 67.39% |

| 5-year | 93.64% |

| YTD | 20.31% |

| 2023 | 4.20% |

| 2022 | 15.97% |

| 2021 | 27.85% |

| 2020 | 1.41% |

| 2019 | 22.94% |

CB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CB

Want to see what other sources are saying about Chubb Ltd's financials and stock price? Try the links below:Chubb Ltd (CB) Stock Price | Nasdaq

Chubb Ltd (CB) Stock Quote, History and News - Yahoo Finance

Chubb Ltd (CB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...