Chico's FAS, Inc. (CHS): Price and Financial Metrics

CHS Price/Volume Stats

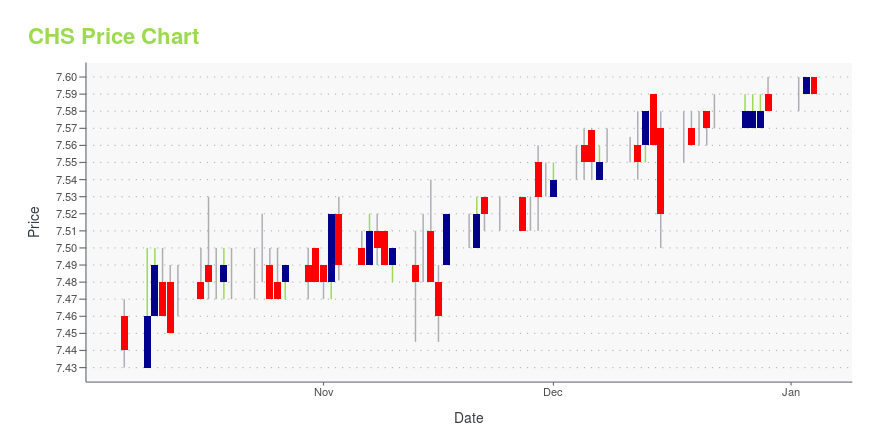

| Current price | $7.59 | 52-week high | $7.60 |

| Prev. close | $7.60 | 52-week low | $4.33 |

| Day low | $7.59 | Volume | 7,324,100 |

| Day high | $7.60 | Avg. volume | 5,248,000 |

| 50-day MA | $7.53 | Dividend yield | N/A |

| 200-day MA | $6.03 | Market Cap | 937.04M |

CHS Stock Price Chart Interactive Chart >

Chico's FAS, Inc. (CHS) Company Bio

Chico's FAS is a specialty retailer of women's private branded, sophisticated, casual-to-dressy clothing, intimates, complementary accessories, and other non-clothing items. The company was founded in 1983 and is based in Fort Myers, Florida.

Latest CHS News From Around the Web

Below are the latest news stories about CHICO'S FAS INC that investors may wish to consider to help them evaluate CHS as an investment opportunity.

Macy’s Takeover Could Put Shareholders Out of MiseryM stock is surging higher today as investors warm up to the idea that Macy's could be joining a list of retailers going private. |

Chico's FAS Inc (CHS) Reports Third Quarter Earnings Aligned with ExpectationsNet Sales Reach $505 Million with Adjusted EPS of $0.11 Amid Pending Acquisition by Sycamore Partners |

Chico's FAS (CHS) Q3 Earnings Top Estimates, Guidance WithdrawnChico's FAS (CHS) reports third-quarter fiscal 2023 results, with revenues declining 2.5% year over year due to a 2.7% fall in comparable sales. |

Chico's (CHS) Reports Q3 Earnings: What Key Metrics Have to SayWhile the top- and bottom-line numbers for Chico's (CHS) give a sense of how the business performed in the quarter ended October 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values. |

Chico's FAS, Inc. Reports Third Quarter Results in Line with OutlookChico's FAS, Inc. (NYSE: CHS) ("Company" or "Chico's FAS") today announced its financial results for the thirteen weeks ended October 28, 2023 ("third quarter"). |

CHS Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 28.86% |

| 3-year | 26.50% |

| 5-year | 161.26% |

| YTD | 0.13% |

| 2023 | 54.07% |

| 2022 | -8.55% |

| 2021 | 238.36% |

| 2020 | -56.50% |

| 2019 | -26.13% |

Continue Researching CHS

Want to see what other sources are saying about Chico'S Fas Inc's financials and stock price? Try the links below:Chico'S Fas Inc (CHS) Stock Price | Nasdaq

Chico'S Fas Inc (CHS) Stock Quote, History and News - Yahoo Finance

Chico'S Fas Inc (CHS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...