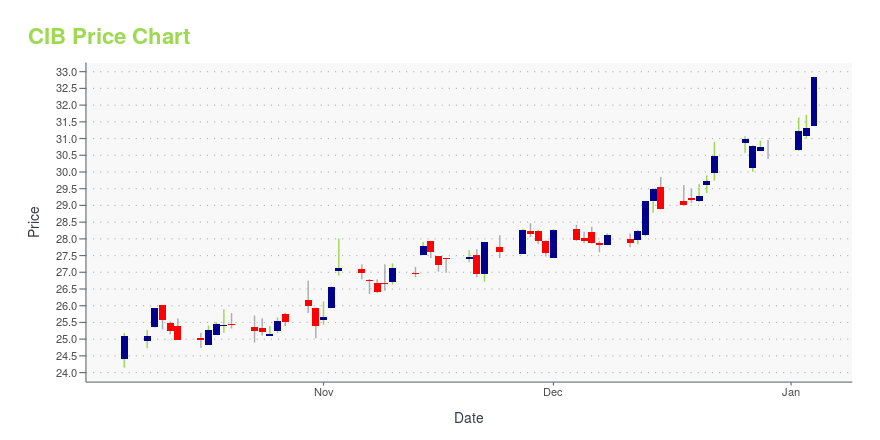

BanColombia S.A. (CIB): Price and Financial Metrics

CIB Price/Volume Stats

| Current price | $32.94 | 52-week high | $37.85 |

| Prev. close | $32.79 | 52-week low | $24.15 |

| Day low | $32.79 | Volume | 122,500 |

| Day high | $33.01 | Avg. volume | 274,080 |

| 50-day MA | $34.15 | Dividend yield | 10.22% |

| 200-day MA | $31.69 | Market Cap | 7.92B |

CIB Stock Price Chart Interactive Chart >

BanColombia S.A. (CIB) Company Bio

Bancolombia SA provides financial products and services to a diversified individual, corporate and government customer base throughout Colombia, Latin America and the Caribbean region. The company was founded in 1945 and is based in Medellín, Colombia.

Latest CIB News From Around the Web

Below are the latest news stories about BANCOLOMBIA SA that investors may wish to consider to help them evaluate CIB as an investment opportunity.

BanColombia SA's Dividend AnalysisBanColombia SA (NYSE:CIB) recently announced a dividend of $0.88 per share, payable on 2024-01-12, with the ex-dividend date set for 2023-12-27. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into BanColombia SA's dividend performance and assess its sustainability. |

The 7 Best Bargain Growth Stocks to Buy Before 2024These bargain growth stocks offer significant upside potential alongside decent margins of safety, for those seeking impressive value. |

Emerging Market Marvels: 7 Stocks Set to Soar in Developing EconomiesThe past few years have been all about U.S. tech stocks. |

These 3 Dividend Stocks Yield Over 10% AND Have Triple-Digit UpsideThese unloved dividend stocks are offering hearty yields and substantial upside potential for patient investors. |

Bancolombia S.A. (NYSE:CIB) Q3 2023 Earnings Call TranscriptBancolombia S.A. (NYSE:CIB) Q3 2023 Earnings Call Transcript November 9, 2023 Bancolombia S.A. misses on earnings expectations. Reported EPS is $ EPS, expectations were $1.36. Operator: Good morning, ladies and gentlemen, and welcome to Bancolombia’s Third Quarter 2023 Earnings Conference Call. My name is Ryan, and I will be your operator for today’s call. [Operator […] |

CIB Price Returns

| 1-mo | 2.89% |

| 3-mo | 3.05% |

| 6-mo | 9.25% |

| 1-year | 23.19% |

| 3-year | 45.82% |

| 5-year | -11.16% |

| YTD | 12.83% |

| 2023 | 20.62% |

| 2022 | -2.02% |

| 2021 | -20.77% |

| 2020 | -22.57% |

| 2019 | 47.18% |

CIB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CIB

Here are a few links from around the web to help you further your research on Bancolombia Sa's stock as an investment opportunity:Bancolombia Sa (CIB) Stock Price | Nasdaq

Bancolombia Sa (CIB) Stock Quote, History and News - Yahoo Finance

Bancolombia Sa (CIB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...