CompX International Inc. (CIX): Price and Financial Metrics

CIX Price/Volume Stats

| Current price | $25.37 | 52-week high | $39.91 |

| Prev. close | $25.17 | 52-week low | $17.39 |

| Day low | $25.37 | Volume | 2,626 |

| Day high | $26.00 | Avg. volume | 14,546 |

| 50-day MA | $23.79 | Dividend yield | 4.98% |

| 200-day MA | $25.06 | Market Cap | 312.41M |

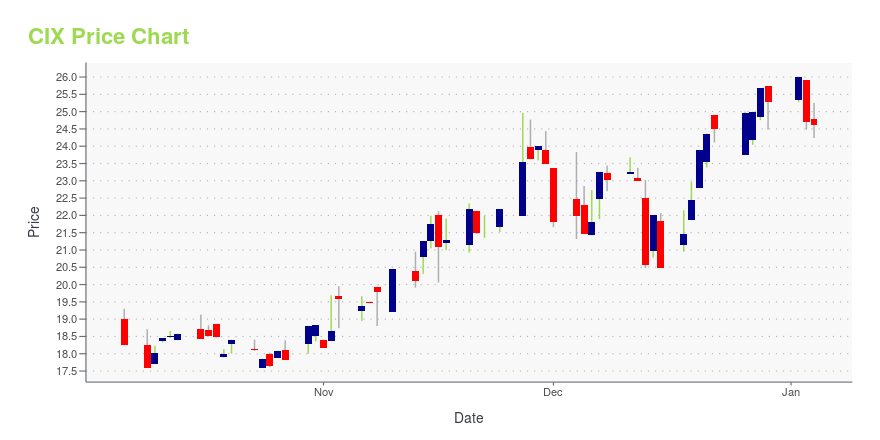

CIX Stock Price Chart Interactive Chart >

CompX International Inc. (CIX) Company Bio

CompX International Inc. engages in the manufacture and sale of security products and recreational marine components primarily in North America. The company operates through two segments, Security Products and Marine Components. The company was founded in 1993 and is based in Dallas, Texas.

Latest CIX News From Around the Web

Below are the latest news stories about COMPX INTERNATIONAL INC that investors may wish to consider to help them evaluate CIX as an investment opportunity.

Compx International Inc (CIX) Reports Q3 2023 Earnings: Sales Down, Net Income UpA detailed look at Compx International Inc's third quarter 2023 earnings |

COMPX REPORTS THIRD QUARTER 2023 RESULTSDallas, Texas, Nov. 01, 2023 (GLOBE NEWSWIRE) -- CompX International Inc. (NYSE American: CIX) announced today sales of $40.3 million for the third quarter of 2023 compared to $42.9 million in the same period of 2022. Operating income was $6.6 million in the third quarter of 2023 compared to $6.0 million in the same period of 2022. Net income was $5.8 million, or $.47 per basic and diluted common share, for the third quarter of 2023 compared to $4.9 million, or $.40 per basic and diluted common |

Compx International Inc: A High-Performing Stock with a GF Score of 93GF Score analysis |

COMPX REPORTS SECOND QUARTER 2023 RESULTSDallas, Texas, Aug. 01, 2023 (GLOBE NEWSWIRE) -- CompX International Inc. (NYSE American: CIX) announced today sales of $36.6 million for the second quarter of 2023 compared to $41.6 million in the same period of 2022. Operating income was $4.4 million in the second quarter of 2023 compared to $7.7 million in the same period of 2022. Net income was $4.0 million, or $.33 per basic and diluted common share, for the second quarter of 2023 compared to $6.2 million, or $.50 per basic and diluted comm |

Compx International: A Safe Industrial Stock With a High Dividend YieldThe stock has the highest possible Piotroski F-Score, showing stellar fundamentals |

CIX Price Returns

| 1-mo | 4.92% |

| 3-mo | -25.03% |

| 6-mo | 15.03% |

| 1-year | 15.29% |

| 3-year | 58.32% |

| 5-year | 100.04% |

| YTD | 2.65% |

| 2023 | 43.62% |

| 2022 | -7.98% |

| 2021 | 64.41% |

| 2020 | 0.31% |

| 2019 | 9.21% |

CIX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CIX

Want to do more research on Compx International Inc's stock and its price? Try the links below:Compx International Inc (CIX) Stock Price | Nasdaq

Compx International Inc (CIX) Stock Quote, History and News - Yahoo Finance

Compx International Inc (CIX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...