Citizens Holding Company (CIZN): Price and Financial Metrics

CIZN Price/Volume Stats

| Current price | $7.90 | 52-week high | $12.00 |

| Prev. close | $7.85 | 52-week low | $6.64 |

| Day low | $7.84 | Volume | 39,013 |

| Day high | $7.91 | Avg. volume | 7,050 |

| 50-day MA | $7.80 | Dividend yield | 8.13% |

| 200-day MA | $8.39 | Market Cap | 44.52M |

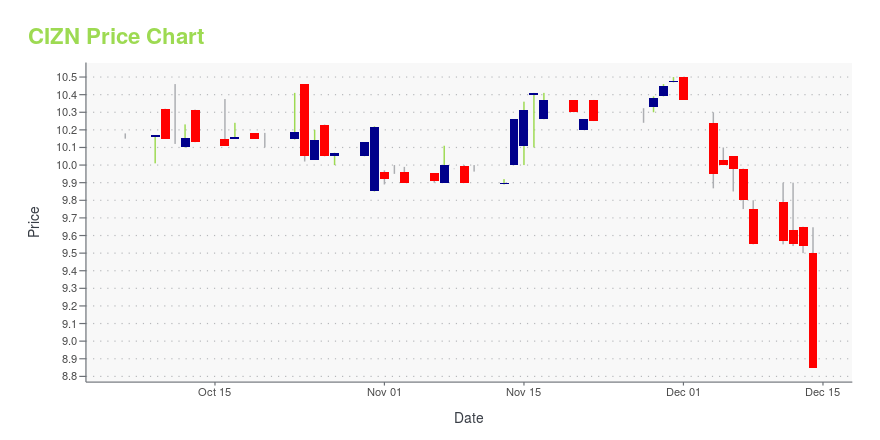

CIZN Stock Price Chart Interactive Chart >

Citizens Holding Company (CIZN) Company Bio

Citizens Holding Company operates as the bank holding company for The Citizens Bank of Philadelphia that provides various commercial and personal banking products and services. The company offers demand deposits, as well as savings and time deposit accounts. It also provides secured and unsecured loans; mortgage loans; installment loans; credit card loans; single and multi-family housing, farm, residential and commercial construction, and commercial real estate loans; commercial, industrial, and agricultural production loans; and consumer loans, as well as issues letters of credit. In addition, the company offers personal and corporate trust services; credit life and title insurance; and internet banking services. It operates 27 branches in East Central and South Mississippi; and a loan production office in North Mississippi. Citizens Holding Company was founded in 1908 and is headquartered in Philadelphia, Mississippi.

Latest CIZN News From Around the Web

Below are the latest news stories about CITIZENS HOLDING CO that investors may wish to consider to help them evaluate CIZN as an investment opportunity.

OTC Markets Group Welcomes Citizens Holding Co. to OTCQXNEW YORK, Dec. 15, 2023 (GLOBE NEWSWIRE) -- OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for 12,000 U.S. and international securities, today announced Citizens Holding Co. (OTCQX: CIZN), a one-bank holding company and the parent of The Citizens Bank of Philadelphia, has qualified to trade on the OTCQX® Best Market. Citizens Holding Co. previously traded on NASDAQ. Citizens Holding Co. begins trading today on OTCQX under the symbol “CIZN.” U.S. investors can find current fi |

Citizens Holding Company Announces Voluntary Delisting from the Nasdaq Global MarketPHILADELPHIA, Miss., December 01, 2023--Citizens Holding Company (the "Company") (NASDAQ:CIZN), the holding company for The Citizens Bank of Philadelphia (the "Bank"), today announced its voluntary decision to delist its common stock from the NASDAQ Global Market ("Nasdaq") and to deregister its common stock under Section 12(b) of the Securities Exchange Act of 1934 (the "Exchange Act"). |

Citizens Holding Company Announces Quarterly DividendPHILADELPHIA, Miss., November 30, 2023--Citizens Holding Company (the "Company") (NASDAQ:CIZN) today announced that its Board of Directors has declared a quarterly dividend of $0.16 per share on its common stock. The dividend is payable on December 29, 2023, to shareholders of record as of December 15, 2023. |

Citizens Holding Company Reports EarningsPHILADELPHIA, Miss., October 27, 2023--Citizens Holding Company (the "Company") (NASDAQ:CIZN) announced today results of operations for the three and nine months ended September 30, 2023. |

Shareholders in Citizens Holding (NASDAQ:CIZN) are in the red if they invested five years agoFor many, the main point of investing is to generate higher returns than the overall market. But every investor is... |

CIZN Price Returns

| 1-mo | 1.94% |

| 3-mo | 2.61% |

| 6-mo | 4.63% |

| 1-year | -29.11% |

| 3-year | -46.60% |

| 5-year | -51.47% |

| YTD | 6.25% |

| 2023 | -39.70% |

| 2022 | -22.54% |

| 2021 | -5.85% |

| 2020 | -0.01% |

| 2019 | 9.14% |

CIZN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CIZN

Here are a few links from around the web to help you further your research on Citizens Holding Co's stock as an investment opportunity:Citizens Holding Co (CIZN) Stock Price | Nasdaq

Citizens Holding Co (CIZN) Stock Quote, History and News - Yahoo Finance

Citizens Holding Co (CIZN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...