Clipper Realty Inc. (CLPR): Price and Financial Metrics

CLPR Price/Volume Stats

| Current price | $3.98 | 52-week high | $6.86 |

| Prev. close | $3.91 | 52-week low | $3.38 |

| Day low | $3.91 | Volume | 103,602 |

| Day high | $4.07 | Avg. volume | 73,801 |

| 50-day MA | $3.77 | Dividend yield | 9.74% |

| 200-day MA | $4.56 | Market Cap | 63.99M |

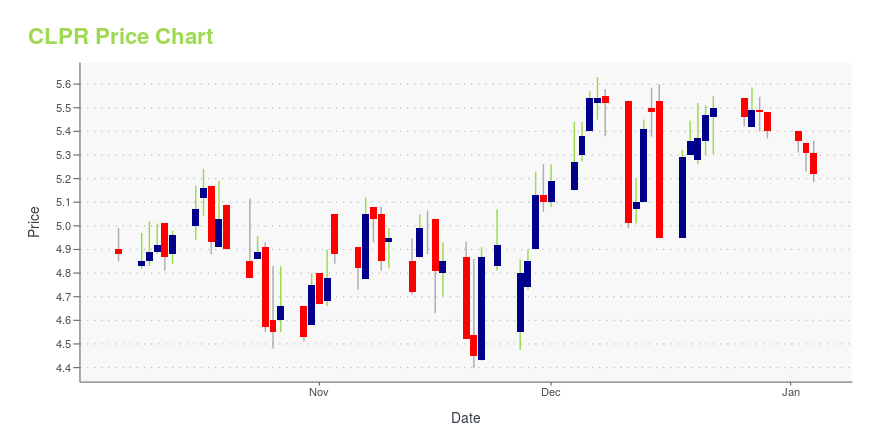

CLPR Stock Price Chart Interactive Chart >

Clipper Realty Inc. (CLPR) Company Bio

Clipper Realty Inc., a real estate company, acquires, owns, manages, operates, and repositions multi-family residential and commercial properties in the New York metropolitan area. It operates through Commercial and Residential segments. Clipper Realty Inc. was founded in 2015 and is and is based in New York, New York.

Latest CLPR News From Around the Web

Below are the latest news stories about CLIPPER REALTY INC that investors may wish to consider to help them evaluate CLPR as an investment opportunity.

Clipper Realty Inc. (NYSE:CLPR) Q3 2023 Earnings Call TranscriptClipper Realty Inc. (NYSE:CLPR) Q3 2023 Earnings Call Transcript November 2, 2023 Clipper Realty Inc. misses on earnings expectations. Reported EPS is $ EPS, expectations were $0.17. Operator: Good day and welcome to the Clipper Realty Quarterly Earnings Call. At this time, all participants have been placed on a listen-only mode and the floor will […] |

Q3 2023 Clipper Realty Inc Earnings CallQ3 2023 Clipper Realty Inc Earnings Call |

Clipper Realty Inc. (CLPR) Lags Q3 FFO and Revenue EstimatesClipper Realty Inc. (CLPR) delivered FFO and revenue surprises of -11.76% and 6.08%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Clipper Realty Inc (CLPR) Reports Q3 2023 Earnings: Record Revenues and NOI Amidst Net LossDespite a net loss, the company sees record quarterly revenues, income from operations, and net operating income |

Clipper Realty Inc. Announces Third Quarter 2023 ResultsNEW YORK, November 02, 2023--Clipper Realty Inc. (NYSE: CLPR) (the "Company"), a leading owner and operator of multifamily residential and commercial properties in the New York metropolitan area, today announced financial and operating results for the three months ended September 30, 2023. |

CLPR Price Returns

| 1-mo | 12.43% |

| 3-mo | 2.69% |

| 6-mo | -18.22% |

| 1-year | -31.03% |

| 3-year | -42.58% |

| 5-year | -51.69% |

| YTD | -22.91% |

| 2023 | -9.54% |

| 2022 | -32.70% |

| 2021 | 47.70% |

| 2020 | -29.45% |

| 2019 | -16.10% |

CLPR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CLPR

Want to do more research on Clipper Realty Inc's stock and its price? Try the links below:Clipper Realty Inc (CLPR) Stock Price | Nasdaq

Clipper Realty Inc (CLPR) Stock Quote, History and News - Yahoo Finance

Clipper Realty Inc (CLPR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...