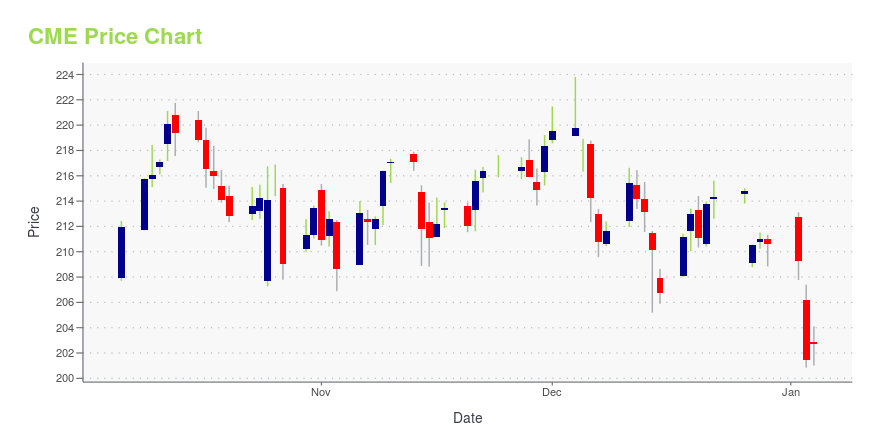

CME Group Inc. CI A (CME): Price and Financial Metrics

CME Price/Volume Stats

| Current price | $200.54 | 52-week high | $223.80 |

| Prev. close | $199.38 | 52-week low | $190.70 |

| Day low | $198.85 | Volume | 1,259,500 |

| Day high | $201.49 | Avg. volume | 1,963,713 |

| 50-day MA | $200.40 | Dividend yield | 2.33% |

| 200-day MA | $208.90 | Market Cap | 72.21B |

CME Stock Price Chart Interactive Chart >

CME Group Inc. CI A (CME) Company Bio

CME Group Inc. (Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, The Commodity Exchange) is an American global markets company. It is the world's largest financial derivatives exchange, and trades in asset classes that include agricultural products, currencies, energy, interest rates, metals, stock indexes and cryptocurrencies futures. The company offers futures contracts and options on futures using its CME Globex trading platforms, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates a central counterparty clearing provider, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana. (Source:Wikipedia)

Latest CME News From Around the Web

Below are the latest news stories about CME GROUP INC that investors may wish to consider to help them evaluate CME as an investment opportunity.

Bullish About 2024? CME's Charts Suggest Something ElseI miss those days - but now it provides electronic trading globally on its CME Globex platform. The trading volume has been more active the past three months and the On-Balance-Volume (OBV) line started to move sideways in September and declined in December. A weak OBV line suggests that traders are being more aggressive sellers than buyers. |

CME Group Inc's Dividend AnalysisCME Group Inc (NASDAQ:CME) recently announced a dividend of $5.25 per share, payable on 2024-01-18, with the ex-dividend date set for 2023-12-27. Using the data from GuruFocus, let's look into CME Group Inc's dividend performance and assess its sustainability. What Does CME Group Inc Do? |

Here's Why We're Wary Of Buying CME Group's (NASDAQ:CME) For Its Upcoming DividendCME Group Inc. ( NASDAQ:CME ) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day... |

CME Group (CME) Benefitted from Unique DiversificationMawer Investment Management, an asset management company, released its third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, Mawer Investment Management’s International Equity Fund, U.S. Equity Fund, U.S. Mid Cap Equity Fund, Global Equity Fund, Global Small Cap Fund, Emerging Markets Equity Fund, EAFE Large Cap Fund, […] |

CME Group Inc. Announces Fourth-Quarter and Year-End 2023 Earnings Release, Conference CallCME Group Inc. will announce earnings for the fourth quarter and full year of 2023 before the markets open on Wednesday, February 14, 2024. Written highlights for the quarter will be posted on the company's website at 6:00 a.m. Central Time, the same time it provides its earnings press release. The company will also hold an investor conference call that day at 7:30 a.m. Central Time, at which time company executives will take analysts' questions. |

CME Price Returns

| 1-mo | 2.74% |

| 3-mo | -4.38% |

| 6-mo | -1.95% |

| 1-year | 5.73% |

| 3-year | 7.53% |

| 5-year | 20.32% |

| YTD | -3.73% |

| 2023 | 31.32% |

| 2022 | -22.89% |

| 2021 | 29.47% |

| 2020 | -6.34% |

| 2019 | 9.67% |

CME Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CME

Want to do more research on Cme Group Inc's stock and its price? Try the links below:Cme Group Inc (CME) Stock Price | Nasdaq

Cme Group Inc (CME) Stock Quote, History and News - Yahoo Finance

Cme Group Inc (CME) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...