Costamare Inc. (CMRE): Price and Financial Metrics

CMRE Price/Volume Stats

| Current price | $14.10 | 52-week high | $17.58 |

| Prev. close | $14.29 | 52-week low | $8.54 |

| Day low | $13.66 | Volume | 831,617 |

| Day high | $14.12 | Avg. volume | 560,332 |

| 50-day MA | $15.47 | Dividend yield | 3.11% |

| 200-day MA | $11.86 | Market Cap | 1.66B |

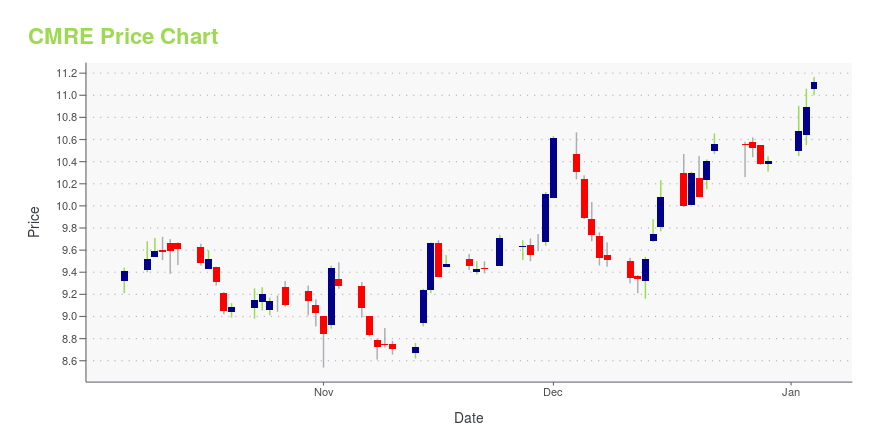

CMRE Stock Price Chart Interactive Chart >

Costamare Inc. (CMRE) Company Bio

Costamare Inc. provides worldwide marine transportation services by chartering its container vessels to the liner operators under long, medium and short-term time charters. The company was founded in 1975 and is based in Athens, Greece.

Latest CMRE News From Around the Web

Below are the latest news stories about COSTAMARE INC that investors may wish to consider to help them evaluate CMRE as an investment opportunity.

Costamare: A Strong Maritime Player With Financial ResiliencyThe company stands as a strong maritime competitor as industry-wide conditions ease |

11 Best Shipping Stocks That Pay DividendsIn this article, we discuss 11 best shipping stocks that pay dividends. You can skip our detailed analysis of the shipping and transportation industry, and go directly to read 5 Best Shipping Stocks That Pay Dividends. In today’s interconnected global economy, the movement of goods across the world holds immense significance. The World Economic Forum […] |

Is Now The Time To Look At Buying Costamare Inc. (NYSE:CMRE)?Costamare Inc. ( NYSE:CMRE ), might not be a large cap stock, but it saw a double-digit share price rise of over 10% in... |

14 Most Undervalued Industrial Stocks To Buy According To Hedge FundsIn this piece, we will take a look at the 14 most undervalued industrial stocks to buy according to hedge funds. If you want to skip our overview of the industrial sector and some recent developments, then take a look at 5 Most Undervalued Industrial Stocks To Buy According To Hedge Funds. If there’s one […] |

13 Best Shipping and Container Stocks To BuyIn this article, we will take a look at the 13 best shipping and container stocks to buy. To skip our recent market trends and activity analysis, you can go directly to see the 5 Best Shipping and Container Stocks to Buy. The usually inconspicuous realm of shipping stocks gained prominence during the COVID-19 pandemic, […] |

CMRE Price Returns

| 1-mo | -15.16% |

| 3-mo | 20.63% |

| 6-mo | 32.01% |

| 1-year | 54.67% |

| 3-year | 60.28% |

| 5-year | 206.10% |

| YTD | 39.41% |

| 2023 | 17.60% |

| 2022 | -21.34% |

| 2021 | 59.04% |

| 2020 | -7.26% |

| 2019 | 132.86% |

CMRE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CMRE

Want to do more research on Costamare Inc's stock and its price? Try the links below:Costamare Inc (CMRE) Stock Price | Nasdaq

Costamare Inc (CMRE) Stock Quote, History and News - Yahoo Finance

Costamare Inc (CMRE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...