CONMED Corporation (CNMD): Price and Financial Metrics

CNMD Price/Volume Stats

| Current price | $48.17 | 52-week high | $78.19 |

| Prev. close | $47.84 | 52-week low | $46.00 |

| Day low | $47.36 | Volume | 489,535 |

| Day high | $49.06 | Avg. volume | 469,463 |

| 50-day MA | $54.62 | Dividend yield | 1.68% |

| 200-day MA | $0.00 | Market Cap | 1.49B |

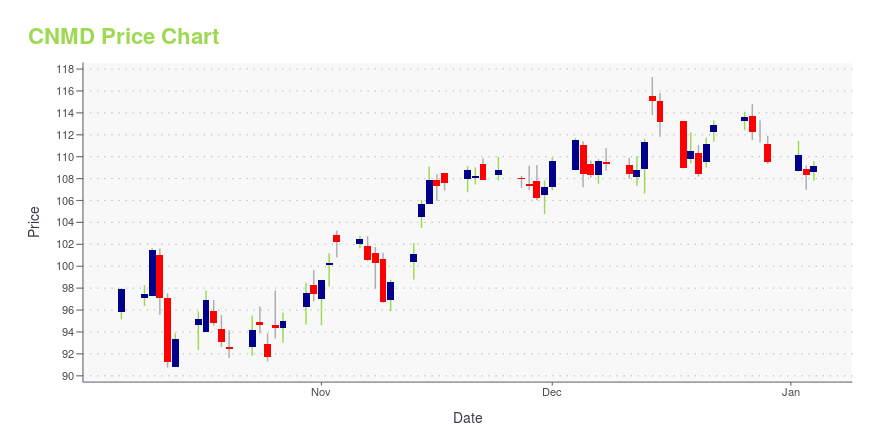

CNMD Stock Price Chart Interactive Chart >

CONMED Corporation (CNMD) Company Bio

CONMED Corporation is a medical technology company that provides surgical devices and equipment for minimally invasive procedures. The Company's products are used by surgeons and physicians in a variety of specialties, including orthopedics, general surgery, gynecology, neurosurgery, and gastroenterology. The company was founded in 1970 and is based in Utica, New York.

CNMD Price Returns

| 1-mo | -7.70% |

| 3-mo | -2.74% |

| 6-mo | -29.17% |

| 1-year | -30.93% |

| 3-year | -51.40% |

| 5-year | -39.52% |

| YTD | -29.12% |

| 2024 | -36.84% |

| 2023 | 24.45% |

| 2022 | -36.98% |

| 2021 | 27.35% |

| 2020 | 1.16% |

CNMD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CNMD

Want to do more research on Conmed Corp's stock and its price? Try the links below:Conmed Corp (CNMD) Stock Price | Nasdaq

Conmed Corp (CNMD) Stock Quote, History and News - Yahoo Finance

Conmed Corp (CNMD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...