Capital One Financial Corp. (COF): Price and Financial Metrics

COF Price/Volume Stats

| Current price | $149.36 | 52-week high | $153.35 |

| Prev. close | $148.09 | 52-week low | $88.23 |

| Day low | $148.41 | Volume | 1,795,000 |

| Day high | $150.10 | Avg. volume | 2,551,485 |

| 50-day MA | $139.61 | Dividend yield | 1.65% |

| 200-day MA | $130.24 | Market Cap | 56.79B |

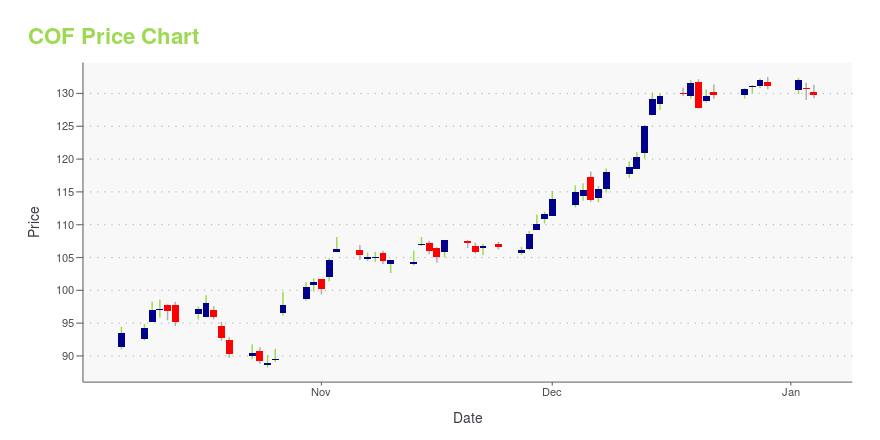

COF Stock Price Chart Interactive Chart >

Capital One Financial Corp. (COF) Company Bio

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the list of largest banks in the United States and has developed a reputation for being a technology-focused bank. (Source:Wikipedia)

Latest COF News From Around the Web

Below are the latest news stories about CAPITAL ONE FINANCIAL CORP that investors may wish to consider to help them evaluate COF as an investment opportunity.

15 Best Dividend Stocks to Buy According to Warren BuffettIn this piece, we will take a look at the 15 best dividend stocks to buy according to Warren Buffett. If you want to skip our overview of the dividend stocks and the latest news, then you can take a look at the 5 Best Dividend Stocks to Buy According to Warren Buffett. The US Federal […] |

13 Most Promising Fintech Stocks To BuyIn this piece, we will take a look at the 13 most promising fintech stocks to buy. If you want to skip our detailed analysis of the financial technology industry, then you can skip ahead to 5 Most Promising Fintech Stocks To Buy. The finance industry is one of the largest in the world. Banks […] |

What's in Your Wallet as Capital One Makes an Upside Breakout?Shares of Capital One Financial have rallied sharply since late October and broken out over the highs of July and February. Will the stock keep going up or is this a "false breakout"? In the daily bar chart of COF, below, I can see a broad-trading sideways market for much of the past year. |

Strength Seen in Capital One (COF): Can Its 3.3% Jump Turn into More Strength?Capital One (COF) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

Capital One continues to top JPMorgan, TD in big-bank satisfaction surveyCapital One holds its spot for a fourth straight year, while Wells Fargo and Truist have secured the bottom two positions, two years in a row, respectively. |

COF Price Returns

| 1-mo | 9.21% |

| 3-mo | 2.59% |

| 6-mo | 8.61% |

| 1-year | 33.61% |

| 3-year | -1.57% |

| 5-year | 67.71% |

| YTD | 14.90% |

| 2023 | 44.32% |

| 2022 | -34.24% |

| 2021 | 49.32% |

| 2020 | -2.66% |

| 2019 | 38.62% |

COF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...