CRISPR Therapeutics AG (CRSP): Price and Financial Metrics

CRSP Price/Volume Stats

| Current price | $52.73 | 52-week high | $63.68 |

| Prev. close | $56.42 | 52-week low | $30.04 |

| Day low | $52.33 | Volume | 3,116,800 |

| Day high | $56.87 | Avg. volume | 2,439,174 |

| 50-day MA | $42.80 | Dividend yield | N/A |

| 200-day MA | $43.47 | Market Cap | 4.55B |

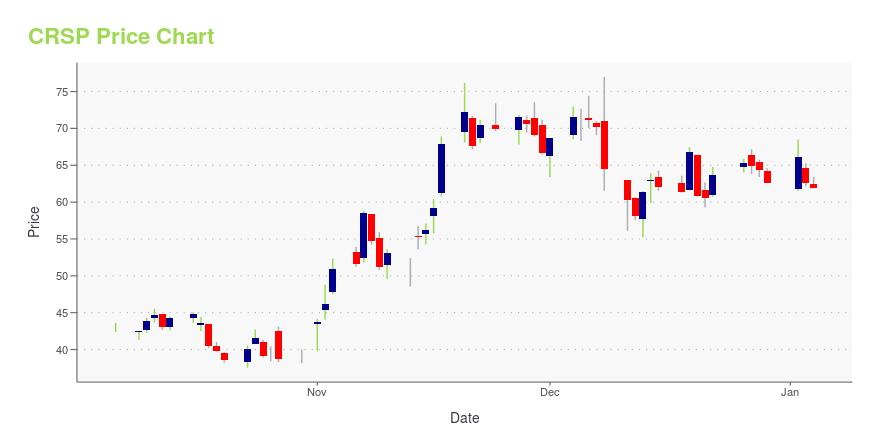

CRSP Stock Price Chart Interactive Chart >

CRISPR Therapeutics AG (CRSP) Company Bio

CRISPR Therapeutics AG focuses on the development of transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 gene-editing platform. The company is based in Basel, Switzerland.

CRSP Price Returns

| 1-mo | 26.82% |

| 3-mo | 39.61% |

| 6-mo | 30.10% |

| 1-year | -15.97% |

| 3-year | -36.77% |

| 5-year | -42.90% |

| YTD | 33.97% |

| 2024 | -37.12% |

| 2023 | 54.00% |

| 2022 | -46.36% |

| 2021 | -50.51% |

| 2020 | 151.39% |

Continue Researching CRSP

Here are a few links from around the web to help you further your research on CRISPR Therapeutics AG's stock as an investment opportunity:CRISPR Therapeutics AG (CRSP) Stock Price | Nasdaq

CRISPR Therapeutics AG (CRSP) Stock Quote, History and News - Yahoo Finance

CRISPR Therapeutics AG (CRSP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...