CrowdStrike Holdings Inc. Cl A (CRWD): Price and Financial Metrics

CRWD Price/Volume Stats

| Current price | $385.83 | 52-week high | $455.59 |

| Prev. close | $372.64 | 52-week low | $200.81 |

| Day low | $377.00 | Volume | 3,195,784 |

| Day high | $392.69 | Avg. volume | 4,115,207 |

| 50-day MA | $385.52 | Dividend yield | N/A |

| 200-day MA | $334.70 | Market Cap | 95.64B |

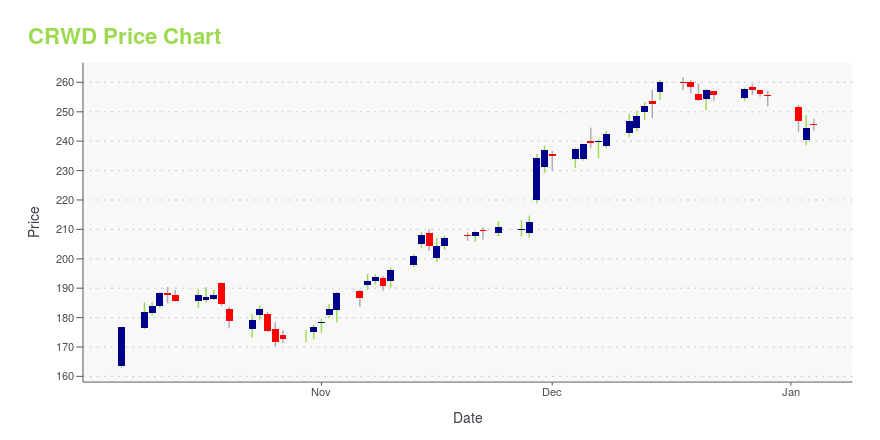

CRWD Stock Price Chart Interactive Chart >

CrowdStrike Holdings Inc. Cl A (CRWD) Company Bio

CrowdStrike Holdings, Inc. is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. The company has been involved in investigations of several high-profile cyberattacks, including the 2014 Sony Pictures hack, the 2015–16 cyber attacks on the Democratic National Committee (DNC), and the 2016 email leak involving the DNC. (Source:Wikipedia)

CRWD Price Returns

| 1-mo | -5.13% |

| 3-mo | N/A |

| 6-mo | 37.07% |

| 1-year | 18.80% |

| 3-year | 73.84% |

| 5-year | 557.96% |

| YTD | 12.76% |

| 2024 | 34.01% |

| 2023 | 142.49% |

| 2022 | -48.58% |

| 2021 | -3.34% |

| 2020 | 324.74% |

Loading social stream, please wait...