Cisco Systems, Inc. (CSCO): Price and Financial Metrics

CSCO Price/Volume Stats

| Current price | $47.88 | 52-week high | $58.19 |

| Prev. close | $47.24 | 52-week low | $44.95 |

| Day low | $47.24 | Volume | 16,104,858 |

| Day high | $48.01 | Avg. volume | 19,593,715 |

| 50-day MA | $46.86 | Dividend yield | 3.45% |

| 200-day MA | $49.13 | Market Cap | 192.90B |

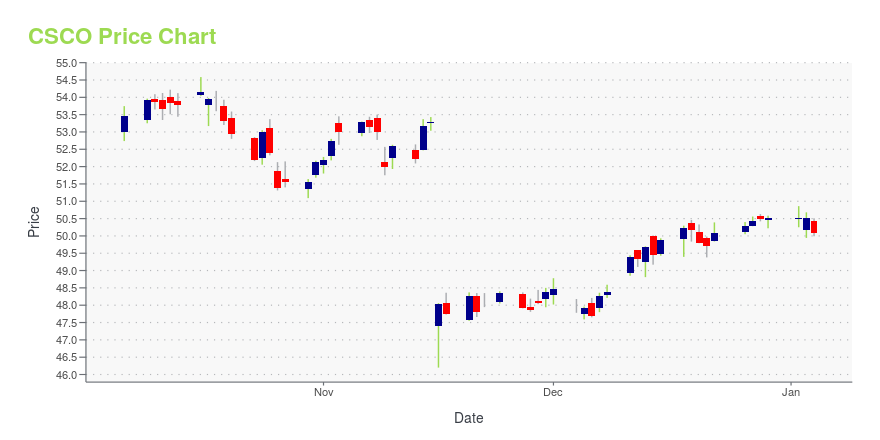

CSCO Stock Price Chart Interactive Chart >

Cisco Systems, Inc. (CSCO) Company Bio

Cisco Systems designs, manufactures, and sells Internet Protocol (IP) based networking products and services related to the communications and information technology industry worldwide. The company was founded in 1984 and is based in San Jose, California.

Latest CSCO News From Around the Web

Below are the latest news stories about CISCO SYSTEMS INC that investors may wish to consider to help them evaluate CSCO as an investment opportunity.

The 3 Hottest 5G Stocks to Watch in 2024With the 5G services market set for unprecedented growth over the next decade, investors cannot ignore the three hottest 5G stocks for 2024. |

The 5G Future: 3 Stocks Leading the Next Communication RevolutionCommunications is one of the most dynamic industries out there, get ahead of its advancements with these communication stocks. |

Is Zoom Video A Buy Amid Artificial Intelligence Software Race?Amid the emergence of generative AI, new corporate products and services could boost Zoom stock but Microsoft looms. |

Top 15 Value Stocks to Buy for 2024In this article, we discuss top 15 value stocks to buy for 2024 picked by Joel Greenblatt. To skip the details about Mr. Greenblatt’s life, portfolio performance, and investment strategy, go directly to Top 5 Value Stocks to Buy for 2024. Investing offers an exciting and effective way of growing wealth over time. Value investing is […] |

13 Most Profitable Robinhood StocksIn this article, we discuss the 13 most profitable Robinhood stocks. If you want to read about some more Robinhood stocks, go directly to 5 Most Profitable Robinhood Stocks. The stock picking habits of retail investors who use platforms like Reddit to strategize and stock trading applications like Robinhood Markets, Inc. (NASDAQ:HOOD) to carry out […] |

CSCO Price Returns

| 1-mo | 3.05% |

| 3-mo | 0.90% |

| 6-mo | -6.63% |

| 1-year | -6.76% |

| 3-year | -5.02% |

| 5-year | -1.03% |

| YTD | -2.88% |

| 2023 | 9.30% |

| 2022 | -22.46% |

| 2021 | 45.76% |

| 2020 | -3.49% |

| 2019 | 13.81% |

CSCO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CSCO

Want to see what other sources are saying about Cisco Systems Inc's financials and stock price? Try the links below:Cisco Systems Inc (CSCO) Stock Price | Nasdaq

Cisco Systems Inc (CSCO) Stock Quote, History and News - Yahoo Finance

Cisco Systems Inc (CSCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...