CTS Corporation (CTS): Price and Financial Metrics

CTS Price/Volume Stats

| Current price | $52.29 | 52-week high | $55.47 |

| Prev. close | $51.92 | 52-week low | $35.50 |

| Day low | $51.71 | Volume | 304,930 |

| Day high | $53.01 | Avg. volume | 152,076 |

| 50-day MA | $51.94 | Dividend yield | 0.3% |

| 200-day MA | $45.29 | Market Cap | 1.61B |

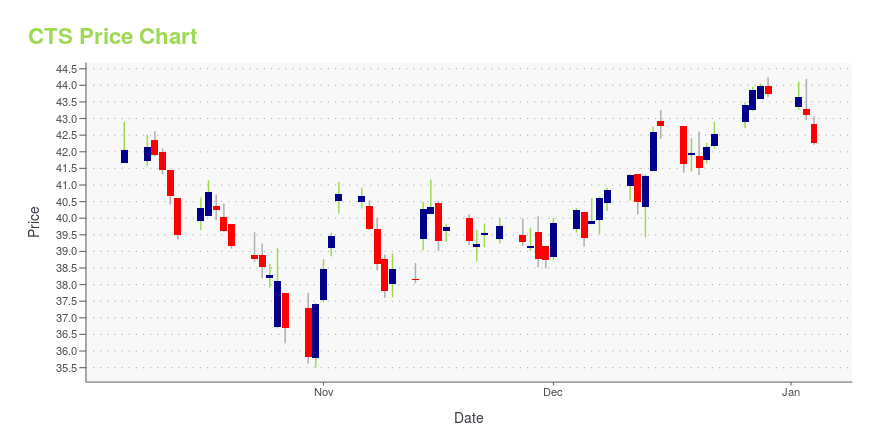

CTS Stock Price Chart Interactive Chart >

CTS Corporation (CTS) Company Bio

CTS Corporation designs, manufactures, and sells a range of sensors, electronic components, and actuators primarily to original equipment manufacturers for the transportation, communications, defense and aerospace, medical, industrial, and information technology markets. The company was founded in 1896 and is based in Elkhart, Indiana.

Latest CTS News From Around the Web

Below are the latest news stories about CTS CORP that investors may wish to consider to help them evaluate CTS as an investment opportunity.

New Strong Sell Stocks for December 20thCTS, CIADY and HRL have been added to the Zacks Rank #5 (Strong Sell) List on December 20, 2023. |

CTS Corporation (NYSE:CTS) Not Flying Under The RadarCTS Corporation's ( NYSE:CTS ) price-to-earnings (or "P/E") ratio of 22.2x might make it look like a sell right now... |

CTS Corporation's (NYSE:CTS) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?With its stock down 13% over the past three months, it is easy to disregard CTS (NYSE:CTS). However, stock prices are... |

The CTS Corp (CTS) Company: A Short SWOT AnalysisUnveiling the Strengths, Weaknesses, Opportunities, and Threats of CTS Corp in Q3 2023 |

With EPS Growth And More, CTS (NYSE:CTS) Makes An Interesting CaseFor beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

CTS Price Returns

| 1-mo | 4.31% |

| 3-mo | 13.37% |

| 6-mo | 25.43% |

| 1-year | 23.68% |

| 3-year | 58.02% |

| 5-year | 65.66% |

| YTD | 19.75% |

| 2023 | 11.38% |

| 2022 | 7.80% |

| 2021 | 7.46% |

| 2020 | 15.18% |

| 2019 | 16.53% |

CTS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CTS

Want to do more research on Cts Corp's stock and its price? Try the links below:Cts Corp (CTS) Stock Price | Nasdaq

Cts Corp (CTS) Stock Quote, History and News - Yahoo Finance

Cts Corp (CTS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...