CURO Group Holdings Corp. (CURO): Price and Financial Metrics

CURO Price/Volume Stats

| Current price | $0.07 | 52-week high | $2.25 |

| Prev. close | $0.09 | 52-week low | $0.04 |

| Day low | $0.04 | Volume | 1,900,700 |

| Day high | $0.12 | Avg. volume | 984,281 |

| 50-day MA | $0.41 | Dividend yield | N/A |

| 200-day MA | $0.94 | Market Cap | 2.89M |

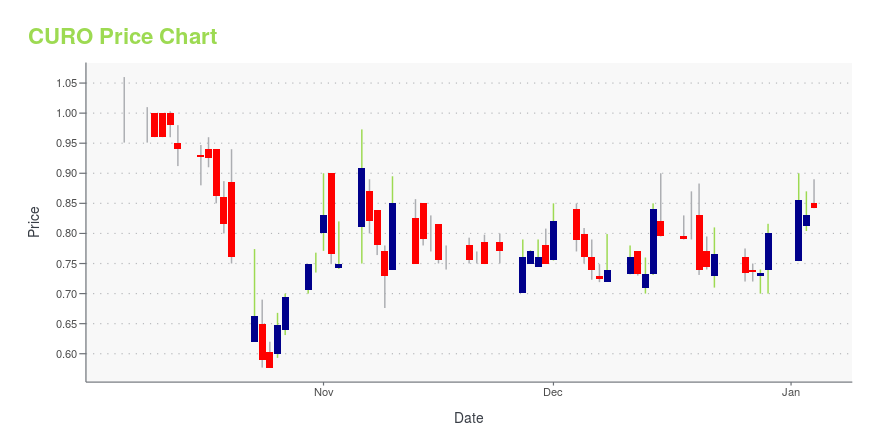

CURO Stock Price Chart Interactive Chart >

CURO Group Holdings Corp. (CURO) Company Bio

CURO Group Holdings Corp. provides consumer finance to a range of underbanked consumers in the United States, Canada, and the United Kingdom. It offers unsecured installment loans, secured installment loans, open-end loans, and single-pay loans, as well as ancillary financial products, including check cashing, proprietary reloadable prepaid debit cards, credit protection insurance, gold buying, retail installment sales, and money transfer services. The company operates under the Speedy Cash, Rapid Cash, Avio Credit, and Cash Money brands; and online as Wage Day Advance, as well as offers installment loans online under the LendDirect brand. The company was formerly known as Speedy Group Holdings Corp. and changed its name to CURO Group Holdings Corp. in May 2016. CURO Group Holdings Corp. was founded in 1997 and is based in Wichita, Kansas

Latest CURO News From Around the Web

Below are the latest news stories about CURO GROUP HOLDINGS CORP that investors may wish to consider to help them evaluate CURO as an investment opportunity.

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

CURO Group Holdings Corp. Closes Two Non-Recourse Facilities and Flexiti EscrowCHICAGO, November 07, 2023--CURO Group Holdings Corp. (NYSE: CURO) ("CURO"), an omni-channel consumer finance company serving consumers in the U.S. and Canada, today announced that on November 3, 2023, Heights Financing II, LLC, an indirect wholly-owned subsidiary of CURO, entered into a new $140 million asset-backed warehouse facility to finance future loans originated by Heights Finance and affiliated entities. The capacity of this facility may be increased to $175 million upon satisfaction of |

CURO Group Holdings Corp. (NYSE:CURO) Q3 2023 Earnings Call TranscriptCURO Group Holdings Corp. (NYSE:CURO) Q3 2023 Earnings Call Transcript November 5, 2023 Operator: Good morning, and welcome to the CURO Group Holdings Third Quarter 2023 Conference Call. All participants will be in a listen-only mode. [Operator Instructions] Please note that this event is being recoded. I would now like to turn the conference over […] |

Q3 2023 CURO Group Holdings Corp Earnings CallQ3 2023 CURO Group Holdings Corp Earnings Call |

Insider Buyers At CURO Group Holdings Recover Some Losses, But Still Down US$56kInsiders who purchased US$233.2k worth of CURO Group Holdings Corp. ( NYSE:CURO ) shares over the past year recouped... |

CURO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -93.27% |

| 1-year | -95.27% |

| 3-year | -99.56% |

| 5-year | -99.27% |

| YTD | -91.25% |

| 2023 | -77.46% |

| 2022 | -77.05% |

| 2021 | 14.46% |

| 2020 | 20.72% |

| 2019 | 28.35% |

Continue Researching CURO

Here are a few links from around the web to help you further your research on CURO Group Holdings Corp's stock as an investment opportunity:CURO Group Holdings Corp (CURO) Stock Price | Nasdaq

CURO Group Holdings Corp (CURO) Stock Quote, History and News - Yahoo Finance

CURO Group Holdings Corp (CURO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...