CohBar, Inc. (CWBR): Price and Financial Metrics

CWBR Price/Volume Stats

| Current price | $0.88 | 52-week high | $6.90 |

| Prev. close | $0.80 | 52-week low | $0.51 |

| Day low | $0.76 | Volume | 681 |

| Day high | $0.88 | Avg. volume | 3,239 |

| 50-day MA | $0.84 | Dividend yield | N/A |

| 200-day MA | $1.79 | Market Cap | 2.56M |

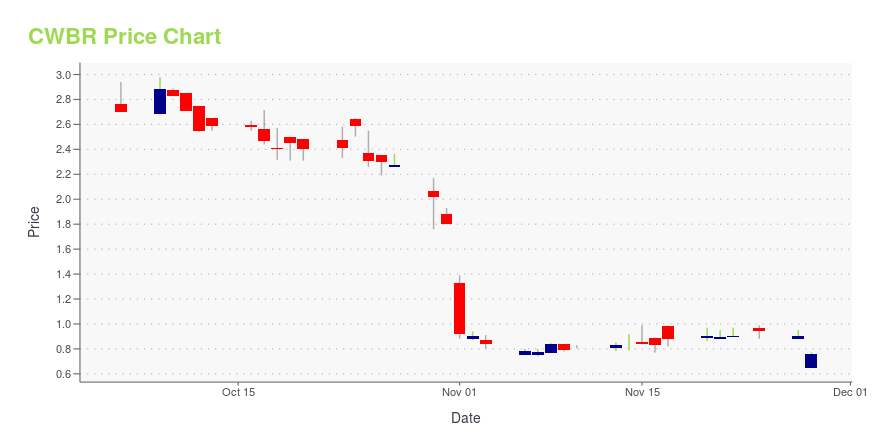

CWBR Stock Price Chart Interactive Chart >

CohBar, Inc. (CWBR) Company Bio

CohBar, Inc., a biotechnology company, engages in the research and development of mitochondria based therapeutics (MBTs) to treat various diseases associated with aging and metabolic dysfunction. Its lead MBT drug candidates include CB4209 and CB4211, which are in IND-enabling studies for the treatment of fatty liver disease, non-alcoholic steatohepatitis, obesity, and type 2 diabetes mellitus. The company is also developing Humanin, a mitochondrial-derived peptide to treat Alzheimer's disease, atherosclerosis, myocardial and cerebral ischemia, and type 2 diabetes mellitus; SHLP-6 for the treatment of cancer; and SHLP-2 to treat Alzheimer's disease and type 2 diabetes mellitus. CohBar, Inc. was founded in 2007 and is headquartered in Menlo Park, California.

Latest CWBR News From Around the Web

Below are the latest news stories about COHBAR INC that investors may wish to consider to help them evaluate CWBR as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're closing out the trading week with a breakdown of the biggest pre-market stock movers worth watching for Friday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayPre-market stock movers are a hot topic this morning and we're checking on the biggest ones investors will want to watch on Friday! |

CohBar Reports Second Quarter 2023 Financial ResultsMENLO PARK, Calif., Aug. 14, 2023 (GLOBE NEWSWIRE) -- CohBar, Inc. (NASDAQ: CWBR) today reported its financial results and highlights for the second quarter ended June 30, 2023. Second Quarter 2023 Summary and Financial Results Entered into Definitive Merger Agreement with Morphogenesis: In May 2023, CohBar announced that the company entered into a definitive merger agreement with a privately held biotechnology company, Morphogenesis, Inc. (“Morphogenesis”), for an all-stock transaction to advan |

Morphogenesis, Inc. and CohBar, Inc. Announce Positive Results from Phase 1b Trial of IFx-Hu2.0, a Novel Personalized Cancer Vaccine, in Checkpoint Inhibitor Resistant Advanced Merkel Cell Carcinoma (MCC) and Cutaneous Squamous Cell Carcinoma (cSCC)IFx-Hu2.0 demonstrated to have a promising safety profile at all 3 dose schedules tested 5 of 7 (71%) of patients achieved durable systemic anti-tumor responses following IFx-Hu2.0 therapy and rechallenge with an immune checkpoint inhibitor (ICI) in patients who exhibited primary resistance to ICIs Translational biomarker data underscores IFx-Hu2.0 mechanism; Demonstrates activation of systemic tumor-specific immune responses Data presented at the 2023 American Society of Clinical Oncology (ASCO |

Morphogenesis, Inc. and CohBar, Inc. Announce Acceptance of Abstract for Poster Presentation at the 2023 American Society of Clinical Oncology (ASCO) Annual MeetingTAMPA, Fla. and MENLO PARK, Calif., May 30, 2023 (GLOBE NEWSWIRE) -- Morphogenesis, Inc. (“Morphogenesis”), a privately-held Phase 2/3 clinical-stage biotechnology company developing novel personalized cancer vaccines and tumor microenvironment modulators to overcome resistance to current immunotherapies, and CohBar, Inc. (NASDAQ: CWBR) (“CohBar”), today announced that Morphogenesis’ abstract has been accepted for poster presentation at the 2023 American Society of Clinical Oncology (ASCO) Annua |

CWBR Price Returns

| 1-mo | -12.00% |

| 3-mo | 13.46% |

| 6-mo | -61.32% |

| 1-year | -49.71% |

| 3-year | -97.74% |

| 5-year | -98.83% |

| YTD | 18.92% |

| 2023 | -56.34% |

| 2022 | -83.85% |

| 2021 | -73.89% |

| 2020 | -16.25% |

| 2019 | -48.55% |

Loading social stream, please wait...