Danaher Corp. (DHR): Price and Financial Metrics

DHR Price/Volume Stats

| Current price | $273.91 | 52-week high | $277.72 |

| Prev. close | $270.09 | 52-week low | $182.09 |

| Day low | $271.19 | Volume | 2,810,147 |

| Day high | $277.72 | Avg. volume | 2,922,034 |

| 50-day MA | $255.82 | Dividend yield | 0.41% |

| 200-day MA | $238.28 | Market Cap | 202.88B |

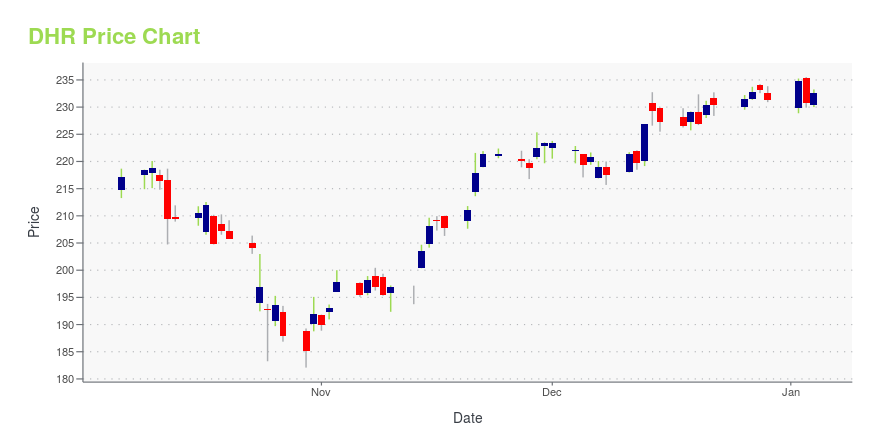

DHR Stock Price Chart Interactive Chart >

Danaher Corp. (DHR) Company Bio

Danaher Corporation is an American globally diversified conglomerate with its headquarters in Washington, D.C.. The company designs, manufactures, and markets professional, medical, industrial, and commercial products and services. The company's 3 platforms are "Life Sciences", "Diagnostics", and "Environmental & Applied Solutions". (Source:Wikipedia)

Latest DHR News From Around the Web

Below are the latest news stories about DANAHER CORP that investors may wish to consider to help them evaluate DHR as an investment opportunity.

Danaher (DHR) Beats Stock Market Upswing: What Investors Need to KnowDanaher (DHR) closed the most recent trading day at $232.86, moving +0.63% from the previous trading session. |

Top 3 Healthcare Stock Picks for the New YearBuy these healthcare stocks for 2024 trading at bargain prices before their earnings inflect higher on improving fundamentals. |

Danaher Schedules Fourth Quarter 2023 Earnings Conference CallDanaher Corporation (NYSE: DHR) announced that it will webcast its quarterly earnings conference call for the fourth quarter 2023 on Tuesday, January 30, 2024 beginning at 8:00 a.m. ET and lasting approximately one hour. During the call, the company will discuss its financial performance, as well as future expectations. |

Centi-Billionaire Bill Gates’ Top 15 Dividend StocksIn this article, we discuss centi-billionaire Bill Gates’ top 15 dividend stocks. You can skip our detailed analysis of Bill Gates’ investment philosophy and his major investments, and go directly to read Bill Gates’ Top 5 Dividend Stocks. Every investor dreams of accumulating higher returns and making massive profits while investing in the equity markets. […] |

Reasons to Retain Danaher (DHR) Stock in Your Portfolio NowStrength in the Life Sciences segment and accretive acquisition bode well for Danaher (DHR). The company's measures to reward its shareholders are encouraging. |

DHR Price Returns

| 1-mo | 8.13% |

| 3-mo | 11.20% |

| 6-mo | 17.81% |

| 1-year | 21.57% |

| 3-year | 7.58% |

| 5-year | 121.54% |

| YTD | 18.66% |

| 2023 | -1.24% |

| 2022 | -19.02% |

| 2021 | 48.57% |

| 2020 | 45.34% |

| 2019 | 49.55% |

DHR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DHR

Want to see what other sources are saying about Danaher Corp's financials and stock price? Try the links below:Danaher Corp (DHR) Stock Price | Nasdaq

Danaher Corp (DHR) Stock Quote, History and News - Yahoo Finance

Danaher Corp (DHR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...