Physicians Realty Trust Common Shares of Beneficial Interest (DOC): Price and Financial Metrics

DOC Price/Volume Stats

| Current price | $21.90 | 52-week high | $22.38 |

| Prev. close | $20.76 | 52-week low | $15.24 |

| Day low | $20.94 | Volume | 8,948,525 |

| Day high | $22.02 | Avg. volume | 6,057,449 |

| 50-day MA | $19.85 | Dividend yield | 5.71% |

| 200-day MA | $18.52 | Market Cap | 15.41B |

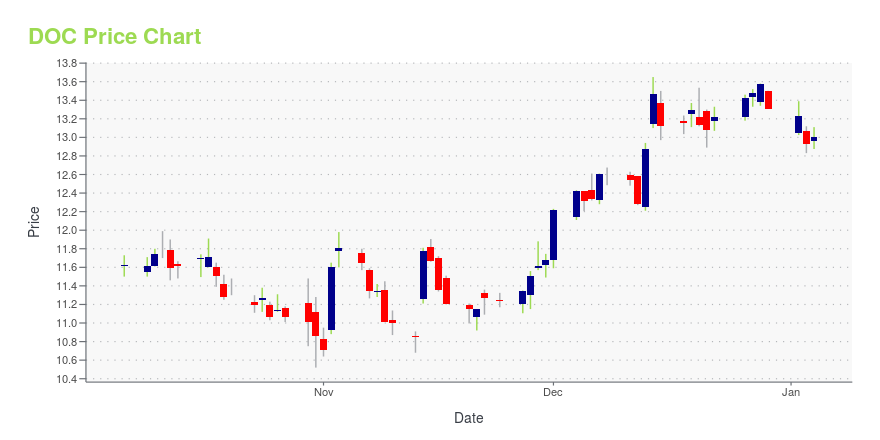

DOC Stock Price Chart Interactive Chart >

Physicians Realty Trust Common Shares of Beneficial Interest (DOC) Company Bio

Physicians Realty Trust is a self-managed healthcare real estate company organized to acquire, selectively develop, own and manage healthcare properties that are leased to physicians, hospitals and healthcare delivery systems. The company was founded in 2013 and is based in Milwaukee, Wisconsin.

Latest DOC News From Around the Web

Below are the latest news stories about PHYSICIANS REALTY TRUST that investors may wish to consider to help them evaluate DOC as an investment opportunity.

7 Dividend Stocks for Daring Investors Who Want to Make BankHigh-risk dividend stocks can yield impressive returns for investors willing to assume reasonable risks overall |

These 2 Healthcare Stocks Are Merging – Is It a Buying Opportunity?Healthcare real estate investment trusts Healthpeak Properties (NYSE: PEAK) and Physicians Realty Trust (NYSE: DOC) have agreed to combine their portfolios in a "merger of equals." In this video, Fool. |

Should You Buy Physicians Realty Trust Before It Merges With Healthpeak?The merger will create a healthcare giant, but that doesn't necessarily make it a great stock to buy. |

You Can't Control Company Mergers, But You Can Control What You Do About ThemHealthcare REITs Healthpeak and Physicians Realty are joining forces to gain scale in a sector that's under pressure. |

Healthpeak Properties, Inc. (NYSE:PEAK) Q3 2023 Earnings Call TranscriptHealthpeak Properties, Inc. (NYSE:PEAK) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good morning, and welcome to the Healthpeak Properties and Physicians Realty Trust Conference Call. All participants will be in a listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions] Please note that this event […] |

DOC Price Returns

| 1-mo | 13.06% |

| 3-mo | 18.34% |

| 6-mo | 16.56% |

| 1-year | 9.70% |

| 3-year | -24.43% |

| 5-year | 1.49% |

| YTD | 15.66% |

| 2023 | -12.65% |

| 2022 | -25.17% |

| 2021 | 27.34% |

| 2020 | -4.56% |

| 2019 | 33.05% |

DOC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DOC

Here are a few links from around the web to help you further your research on Physicians Realty Trust's stock as an investment opportunity:Physicians Realty Trust (DOC) Stock Price | Nasdaq

Physicians Realty Trust (DOC) Stock Quote, History and News - Yahoo Finance

Physicians Realty Trust (DOC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...